The EU’s upcoming CO2 standards for light-duty vehicles (LDVs) provide an opportunity to accelerate modernisation and decarbonisation of both the transport and power sectors. This presents a one-time opportunity to boost EU global competitiveness. Adapting these standards to take into account the transformation underway in the power sector could yield huge benefits for the EU’s economy and society. Ignoring that transformation could come at a very high price, particularly if battery electric vehicles charged through the power grid become the powertrain of choice for most consumers. With legislative proposals expected to emerge from the European Commission before the end of this year on both CO2 vehicle standards and power market design, it’s time to start paying attention to the synergies between the power sector and the automobile sector. The European Commission recognises the need to do this, as indicated in its European Strategy for Low-Emission Mobility released last week, but the strategy is short on specific ideas and detail.

Widespread adoption of electric vehicles can help drive decarbonisation of both the power and transportation sectors. The ambition and time frame of policies in both sectors, however, must be designed to work together. RAP’s recent policy brief Electric Cars, the Smart Grid, and the Energy Union: Coordinating vehicle CO2 reduction policy with power sector modernisation considers how new CO2 standards for vehicles could be redesigned to support and benefit from the power sector’s transformation.

A One-Off Competitiveness Opportunity

Electrification of vehicles has the potential to reduce dependency on oil imports by as much as €58 billion to €83 billion per year by 2030, according to a study by AEA-Ricardo and Cambridge Econometrics. The switch would also create 500,000 to 1.1 million net jobs. And there are the benefits of technological advance and innovation to consider, too.

Using metrics and shift indices to track global trends, Deloitte discovered that exponential innovation is happening on the back of exponential improvement in core digital technologies. The company found that the impact of these pioneering technologies is amplified when they interact and combine in innovative ways, leading to new products, services, businesses, and technologies. New entrant Tesla provides a good example of a company that has managed to exploit this opportunity. The disruption that Tesla and firms like it can bring is a very positive thing, as it forces incumbents to adapt much faster than they otherwise would.

A competitive global race for EV development and rollout is certainly on, but the EU is well-positioned to lead. The region has the advantage of a strong industrial base on which to build. The EU has the second largest vehicle market, the highest absolute automotive research and development spending, and high net exports. In a recent UBS Q-series report on the global auto market (subscription required), analysts said that EVs are likely to achieve cost of ownership parity with internal combustion engine cars within just five years in Europe, much earlier than in China and the United States. Transportation and power sector policies will be an important contributor to this equation. A major challenge for the European Commission is how to design regulation to maximise the benefits of the digital and technologic revolution.

Interdependency of EVs and Power Market Design Reforms

Controlled EV charging will limit the extent to which the capacity of the power system will need to expand in order to charge growing numbers of EVs. This requires phasing or sequencing the charging of EVs in order to avoid times when electricity networks are congested or when energy supply is scarce. This is better known as ‘smart charging’, and the term ‘demand response’ is used to describe smart management of energy consumption more broadly.

It’s not just all about avoiding costs—there are big gains to be had too. The demand response that EVs can provide is needed by the power system to balance variable wind and solar energy, the share of which is expected to grow significantly. EVs can provide other useful power system services too. EV owners could get paid to charge their cars at certain times of the day when wind and solar energy is plentiful and to avoid charging when it is not. This is typically easy, as most cars spend much of the day parked at the workplace and all night at home. Because an EV battery is already paid for, demand response from EVs will likely be more competitive than alternatives. This revenue stream for EV owners could reduce the cost of EV ownership or be captured through innovative business models, ultimately leading to faster sales of EVs.

That’s not all either. The benefits of demand response go way beyond managing the cost of the impact of EVs on power networks or reducing cost of EV ownership. The societal benefits of demand response are very large indeed and can potentially substantially reduce all consumers’ electricity bills.

Fortunately, enabling demand response and empowering consumers are central to the European Commission’s upcoming power market design reforms. Unfortunately, enabling demand response will be no easy task as many market barriers need to be overcome through regulatory and market design reforms, as detailed in RAP’s policy brief The Market Design Initiative: Enabling Demand-Side Markets. Much improved power market monitoring—as recommended in RAP’s policy brief Can We Trust Electricity Prices?—will also be a crucial piece of the jigsaw to ensure demand response develops at the needed pace. Ambitious near-term CO2 standards for vehicles that drive up the share of EVs on the road, however, would provide an important motivation to quickly and effectively implement power market design reforms.

The Power Sector Needs Forward-Looking CO2 Vehicle Standards

Power System Planning Involves Very Long Time Horizons

The lack of availability of public charging infrastructure is often cited as a major barrier to EV rollout. Public charging points are indeed a necessity, particularly in urban areas where people don’t have private parking. Installation of charging points, however, are just the “tip of the iceberg” when it comes to preparing power networks for EVs. The full iceberg is the capability of the whole power system to integrate large numbers of EVs, minimising their negative impact and getting the most out of the benefits they bring to the power system. Power system planners and electricity distribution system operators (DSOs) will need to do this as cost-effectively as possible. While they might have the smart technologies at their disposal, what many don’t yet have are regulatory frameworks that would motivate them to do so. Experience tells us that this regulatory and cultural change could take many years, but greater certainty about the pace of EV rollout is an important motivating driver for timely regulatory change.

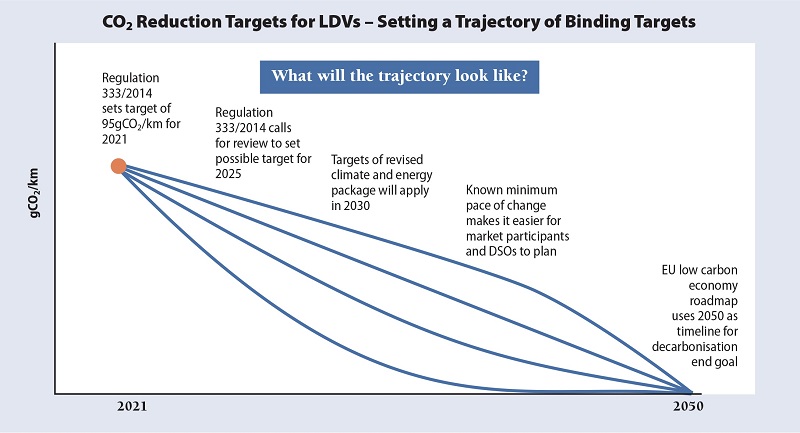

Member States developing infrastructure strategies and DSOs setting out investment plans can only guess what might happen to vehicle CO2 standards and the associated EV rollout beyond 2021. Yet the EU Directive on the deployment of alternative fuels infrastructure requires EU Member States to estimate EV numbers for 2025 and 2030, develop infrastructure strategies based on this demand, and report this information to the European Commission.

Power system asset lifetimes can be up to 45 years and scenarios for infrastructure investment planning look decades ahead, so indeed it makes sense to encourage long-term planning. But the short-term nature of CO2 reduction standards for vehicles is not helpful. Grid planners need to make a large number of assumptions about growth in energy demand, including the rollout of EVs, the extent to which energy demand can be managed, and the sequencing of investment in grid reinforcement according to identified needs and priorities. Greater certainty about these assumptions can reduce margins or allowances for error and so reduce the risk for underutilised or stranded assets.

Risk of Tipping Points

Experts expect EV rollout to be non-linear. Some predict it could be exponential, while others think it could be S-curve, so changes could be rapid. Fluctuations in wholesale oil prices, steep cost reductions in batteries, cheaper power prices, payments to EV owners for demand response, a switch in relative depreciation rates of internal combustion vehicles and EVs, changes to EU fuel taxes, and city air quality restrictions could each bring about a tipping point for EV sales and spur rapid change. The power system needs to be ready.

Vehicle Manufacturers Need Forward-Looking Binding Regulation Too

Vehicle manufacturers will need to plan and invest in new technologies. They will need to innovate, construct new facilities, reorganise production processes and supply chains, and develop strategic partnerships with non-traditional market actors. They will also need to ensure their workforce is retrained. Manufacturers will also need to make choices relating to the share of investment in incrementally improving internal combustion vehicles versus the share of investment in alternative ultra-low emission vehicles (ULEVs).

Longer-term binding CO2 reduction targets would give vehicle manufacturers greater certainty and predictability, crucial for long-term planning and helpful in reducing investment risk. At the same time, near-term targets could capture the benefits of existing innovation and ensure that progress toward the long-term targets stays on track.

What does all this mean for how CO2 vehicle standards are designed?

Much needs to come together at the right time if the EU is to seize the competitiveness opportunities that are clearly there to be had. Coordination of timing and ambition of regulatory change in different sectors is therefore very important if costs are to be minimised and benefits maximised. This should be a central consideration for the design of interacting policies with related or common goals.

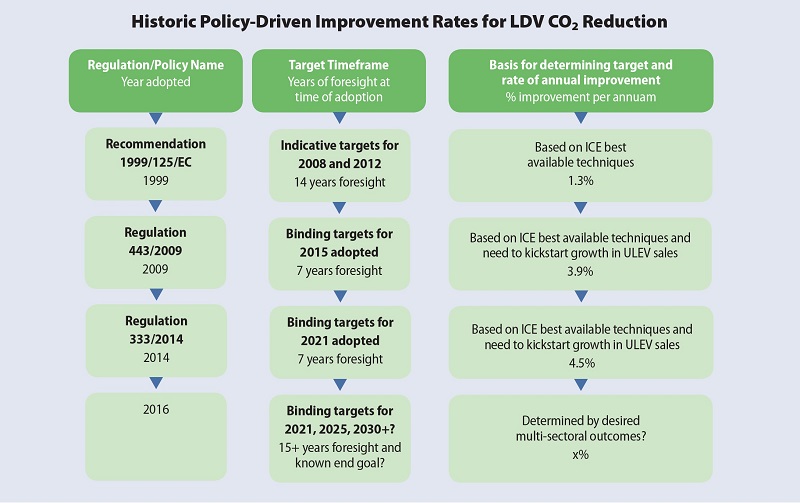

Binding standards have worked in the past but the improvement has been incremental and slow because standards have been based on best-available combustion engine technologies and sales have trended toward larger, more powerful vehicles. Today, things are different because many different models of ULEVs are actually available in car showrooms. So instead of limiting ambition to possible incremental improvements that can be achieved through the best-available techniques for combustion technology, it is now possible to focus on actually achieving end goals and long-term public policy outcomes.

Forward-looking CO2 vehicle standards that coordinate with other EU policy goals will minimise uncertainty and risk for all market actors, particularly power system planners and investors who work to very long time horizons. At the same time, the ambition of nearer term binding targets need to deliver the benefits of existing innovation, keep progress towards long-term goals on track and coordinate with the ambition or objectives of other relevant EU policies.

The recommendations contained in Electric Cars, the Smart Grid, and the Energy Union include setting a trajectory of binding targets for CO2 light-duty vehicle standards that align with relevant medium- and long-term EU policy goals (for example, but not exclusively, the 2030 goals of the EU Climate & Energy Framework, Electricity Market Design Initiative and EU Clean Air Policy Package; and long-term goals of the Roadmap for moving to a competitive low carbon economy in 2050, the Energy Roadmap 2050, the Transport White Paper, and Thematic Strategy on air pollution). In addition, the CO2 reduction targets could be combined with a tradable sales quota applied to ULEVs, an approach which would avoid picking specific technologies. The definition of ULEVs could encompass a variety of very low-emission technologies, including EVs. This would help accelerate change to the pace needed, and car manufacturers could benefit from the flexibility of a tradeable quota.