正如世界上其他国家一样,中国电力行业要走向零碳发展的未来,需要有灵活性资源的支持。储能,特别是电化学储能,由于近年来成本大幅度降低,以及其多重应用价值,前景越来越光明。并网储能能够成本有效地发挥帮助可再生能源并网、提高剩余火电厂运行效率、提供调峰调频等辅助服务、管理电网阻塞、替代输配电设施、抑制价格波动等作用。根据CNESA储能项目库的统计,到2019年底,中国已投运储能项目累计装机32.3 GW, 其中抽水蓄能约30GW,电化学储能约1.6 GW。最近的一些研究发现,在可再生能源以低成本快速发展的情景下,到2030年,中国需要增加储能的累计装机容量到300GW以支持波动性可再生能源并网,从而以低成本降低碳排放。这样的愿景需要在储能友好的政策和市场的双重作用下才能实现。

今年八月底,国家发改委、国家能源局公开征求《关于开展“风光水火储一体化”“源网荷储一体化”的指导意见》意见的公告,在业界引起了广泛的反响。两个一体化提出要根据必要性和可行性优化储能规模,建立灵活高效互动的电力运行与市场体系,落实储能参与市场的机制。然而,中国现阶段无论是用户侧、发电侧或者电网侧储能,应用场景都比较单一,缺乏互相协调且系统优化的运行模式,对未来大规模发展储能形成了阻碍。从国际经验来看,电力现货市场为储能提供了可观的收益,是储能实现商业价值的主要渠道。我们在上一篇文章中,介绍了以光伏和风电为代表的波动性可再生能源参与电力市场的途径,这一篇短文中,主要分享加州独立系统运行商(CAISO)抽水蓄能以外的电储能参与市场模式,希望能为中国政策制定者提供借鉴。

电化学储能参与CAISO市场模式

美国联邦能源监管委员会(FERC)于2018年发布了Order 841, 要求RTO/ISO区域电力市场制定规则为储能公平参与电力市场扫清障碍。841法令规定在考虑物理和运行特征的基础上,允许电储能参与容量、电量、辅助服务市场,并基于市场价格对其服务进行相应的补偿。按照FERC的要求各ISO/RTO随后在现有的市场规则之上制定或者完善了电储能参与市场模式。其中,加州独立运行商(CAISO)在这方面的表现最为突出。截至2020年七月,CAISO有216MW并网运行的电池装机容量,在美国各区域电力批发市场中名列前茅,根据加州综合资源规划预计,CAISO到2030年会有15GW储能资源,其中主要(12GW以上)是电化学储能。这意味着10年后CAISO的储能可能是目前的50多倍,将会很大程度地改变CAISO电力系统的运行。

CAISO早在2012年就开始发展和贯彻储能参与市场模式以推动储能与其他资源公平竞争并获得合理补偿。CAISO主要通过非发电资源模式(NGR,Non-Generator Resource),允许储能资源参与双边容量市场,电能量市场和辅助服务市场。NGR的定义是 “具有连续运行区间,既可以发电又可以耗电的资源” 。现代的电池技术和储能控制系统已经可以支持从放电到充电的近实时切换,可以完成精确快速的响应,但是电池储能仍然受到充放电量的限制,这也是电池的特性决定的。在CAISO, NGR可以选择调频能源管理功能 (REM,Regulation Energy Management),在这种选择下,NGR能够更有效地参与日前调频市场,但不能同时参与电能量市场和运行备用市场。

另外,用户侧的储能(电表后面)也可以以单独或者集合的形式作为需求响应资源参与电能量和辅助服务市场。但是在这种模式下,需要基线来测量需求响应资源的实际绩效。下面主要从几个关键点来介绍NGR储能如何参与CAISO的电能量和辅助服务市场。

- 资质要求-对于NGR, 同其他发电机组一样,电储能必须满足CAISO的相关基本要求(例如,调度运行,遥测和计量规则等),以提供容量、电量和辅助服务。CAISO为满足Order 841规定将所有参与市场的发电侧最小规模改为100kW。如果NGR参与细分市场则必须满足相应市场的具体要求,这些要求也是技术中立的,例如,辅助服务市场和双边容量市场对于资源连续最短运行时间会有具体的要求。CAISO允许电储能根据自身运行特征,在报价时降低可调度容量,以满足相应市场的最短运行时间。

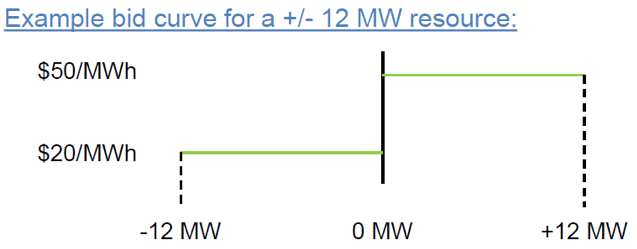

- 报价-在电能量市场上,电储能NGR可以提交电能量报价曲线,包括充电报价(-MW)和放电报价(+MW)(如下图),这种报价曲线允许电储能在一个单独的报价中,反映其经济可行的运行区间,储能可以作为发电、负荷或者两者同时参与市场。此外,电储能也可以提交“价差报价”(spread bid)在电价处于报价区间之外进行充电放电;或者自调度,只报量作为价格接受者。

图 1. 12MW储能资源的报价曲线示例

Licensed with permission from the California ISO. Any statements, conclusions, summaries or other commentaries expressed herein do not reflect the opinions or endorsement of the California ISO. (图1经加州ISO授权许可。本文所表达的任何陈述,结论,摘要或其他评论均不代表加州ISO的观点或认可)

- 物理和运行特征-电储能出力受到物理上下充放电容量限制和爬坡速率的影响,需要在这些限制下保证电池能够完成调度指令提供相应的服务。特别地,在运行过程中,电池应该有什么样的荷电状态(state of charge,即电池中可用电能的状态),由电池自己管理或者ISO来帮助他们进行优化是电储能参与市场关心的一个问题。在CAISO, 电池储能可以在报价时提交参数,包括最大最小荷电状态,最大最小容量限制,之后由CAISO在市场优化时体现这些参数。或者,他们也可以不提交荷电状态参数选择自己管理。最新的提议是允许参与者明确一小时运行之后他们希望达到的荷电状态,以方便储能资源本身和调度的实时管理,并保证NGR对满足日前电能量市场,辅助服务以及长期资源充足等要求不发生冲突。

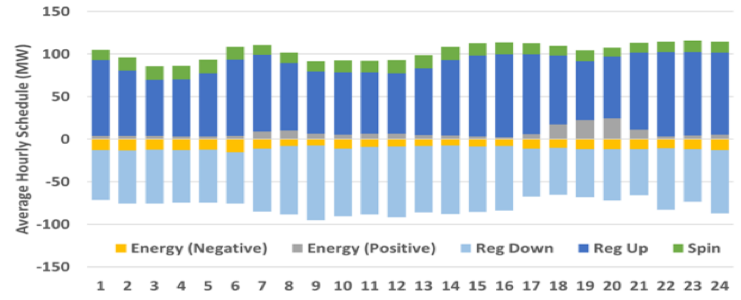

从CAISO市场的经验来看,目前,电储能的价值主要是来自参与调频市场,其次是为了满足资源充裕度,签订双边采购合同,最后是进入电能量市场通过电价套利获得的收入。这个原因主要是电能量市场电价的差别幅度较小、高电价持续时间短,不足以覆盖包括循环充放电的损耗在内的电池成本。日后随着可再生能源弃电的增加,或者随着现货市场价格波动的幅度和频率的增加,可能会扩大电储能在电能量市场的参与度和收入。

图 2 CAISO储能资源的平均每小时调度安排(2019年7-12月)

Licensed with permission from the California ISO. Any statements, conclusions, summaries or other commentaries expressed herein do not reflect the opinions or endorsement of the California ISO.(图2经加州ISO授权许可。本文所表达的任何陈述,结论,摘要或其他评论均不代表加州ISO的观点或认可)

对中国的启发

中国正在进行电力现货市场的建设,一些试点例如,广东、浙江以及甘肃已经着手完善市场规则,尝试将储能纳入电力现货市场–允许储能在日前和实时电能量市场报价,并调动储能在未来调频和备用辅助服务市场中的积极性。为了更好地推动电化学储能无障碍地参与电力市场,可以考虑以下几点:

- 完善现货市场的设计,在电能量和辅助服务市场中实施稀缺性资源定价,让价格信号更好地反映市场的实时需求,有助于储能资源发挥削峰填谷和平抑市场价格波动的作用。需要协同优化电能量市场和辅助服务市场,在合理价格的基础上,根据电储能所提供的服务给予相应的合理补偿。

- 建立电储能参与市场模式,有必要首先确认市场的资质要求,即储能需要满足的调度规则,计量和遥测要求等。第二,明确储能需要提交给调度的物理和运行技术参数(例如,最大最小荷电状态,充放电限制,运行爬坡率)。第三,制定报价具体规范(例如,在报价曲线中可以提交多少量价对)和管理荷电状态的方式方法。

- 探索和其他发电资源和负荷资源共同参与市场的模式,真正体现“光电风电+储能,需求响应+储能”等混合资源优势。以充分竞争为基础的合理的市场价格将会为储能选择何种商业模式以及如何选址提供依据,以深层次挖掘储能可以带来的多重价值。

本文于12月12日刊登在“南方能源观察”,标题为《储能如何参与电力市场?加州启示》

文献参考:

[1] 欲了解更多关于FERC 841令,也可见“美国经验:储能资源如何直接参与现货市场竞争?” https://rapstaging.wpengine.com/blog/can-storage-resources-compete-directly-spot-markets-view-us-cn

[2] NGR/REM允许电储能资源报最高可调度容量,连续最小运行时间要求从正常日前调频市场的一小时减少到15分钟。详情请参考:http://www.caiso.com/Documents/NGR-REMOverview.pdf

[3] California Independent System Operator Corporation. Energy Storage and Distributed Energy Resources Initiative (ESDER4) Draft Final Proposal, May 27, 2020, at p. 11. http://www.caiso.com/InitiativeDocuments/FinalProposal-EnergyStorage-DistributedEnergyResourcesPhase4.pdf

[4] California Independent System Operator Corporation. Figure 9: Average hourly schedules for storage resources (July‐Dec 2019), Energy Storage and Distributed Energy Resources Initiative (ESDER4) Final Proposal (Aug. 2020), at p. 19. http://www.caiso.com/InitiativeDocuments/FinalProposal-EnergyStorage-DistributedEnergyResourcesPhase4.pdf