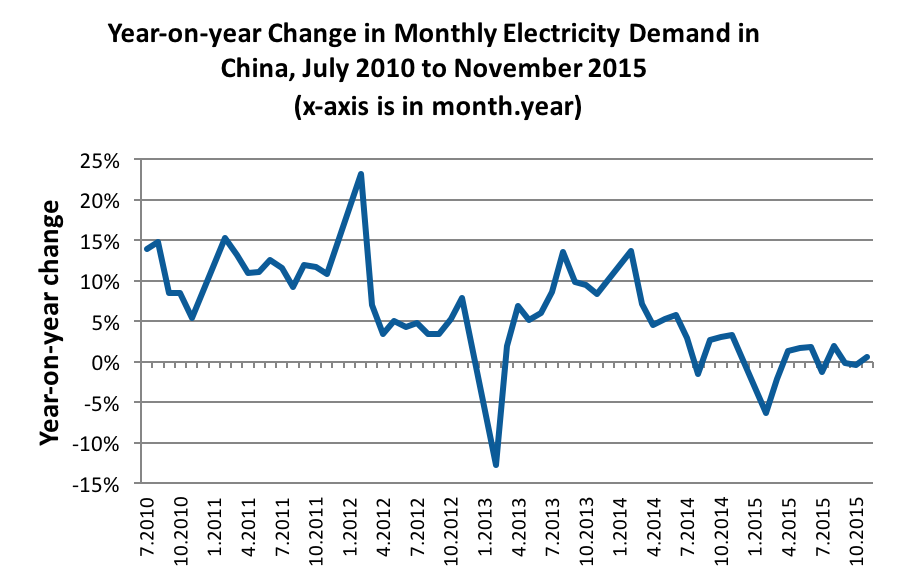

Since the beginning of 2014, demand for electricity in China has fallen dramatically, following more than a decade of double-digit growth. Despite slowing demand growth, there are indications that a large amount of coal-fired generation capacity is currently under development. While a recent policy announcement temporarily suspends the construction of coal-fired power plants in various provinces, much work is needed to properly evaluate the extent of the overcapacity and improve planning and approval processes in China.

Industry experts and stakeholders in China remain divided as to the severity of this excess capacity problem. At a recent conference in Beijing, one group of presenters argued that decreasing capacity utilization for coal generating units indicates a serious overcapacity problem, and that China does not need new coal-fired generation capacity in the near to medium term. A second group of presenters argued that sustained economic growth will drive increased demand for electricity, and that China will need to continue to build new coal-fired generation capacity to meet that demand.

Resolving these divergent views requires the use of quantitative metrics for determining what constitutes a “need” for new generation capacity. These kinds of metrics—such as reliability indicators for measuring total generation capacity needs—have not historically been used in China’s electricity sector.

How Much Coal Overcapacity is There?

Using a screening method commonly used in the U.S., I recently analyzed the need for new coal-fired generation capacity in China over the next five to ten years. The analysis focused narrowly on the amount of generation capacity needed to maintain reliable delivery of electricity.

I found that China already had roughly 100 GW of excess coal-fired generation capacity relative to what was needed for reliability in 2014. Existing coal capacity at the end of 2014 is likely to be adequate to meet reliability needs until at least 2020, and likely well into the decade to follow.

Continued expansion of coal-fired generation poses a significant financial risk to China’s electricity industry and, by extension, to the banks that provide financing, and to the customers who may be forced to shoulder stranded asset costs. Nationally, potential stranded asset costs are on the order of tens of billions of yuan (billions of dollars) per year.

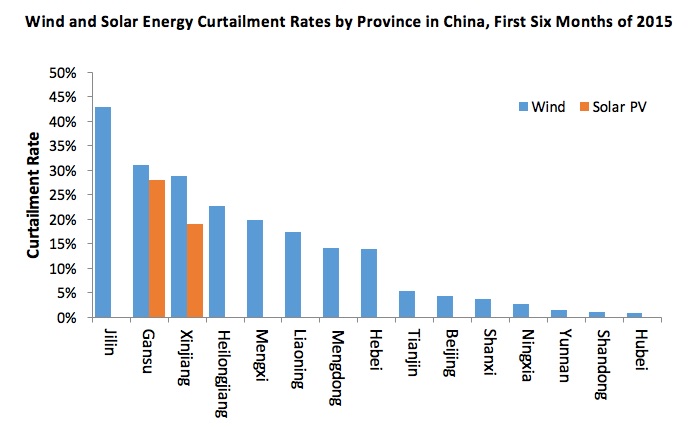

Continued investment in coal generation also poses a threat to China’s clean air and greenhouse gas goals, by “crowding out” cleaner sources of generation. Already, China has very high rates of wind and solar energy curtailment, driven in part by economic conflicts with coal generators (see figure).

How can the Risks of Coal Overcapacity Be Addressed?

China’s recently re-started electricity sector reforms may ultimately provide market solutions to mitigate the risks of excess coal generation capacity, but market designs will take time to implement and are unlikely to mitigate these risks in the near term. Efforts to address them in the nearer term should focus on three areas:

- Developing and institutionalizing quantitative metrics for assessing the need for new resources—focusing on reliability (e.g., loss-of-load probability-based metrics), cost (e.g., present value of total fixed and variable costs over planning horizon), and environment (e.g., SO2, NOx, CO2 emissions);

- Enhancing current generation and transmission planning processes, orienting them more around quantitative metrics; and

- Better linking generation planning and project approval, which have historically not been well linked.

As they work to improve electricity planning, government agencies and corporations in China can draw on more than three decades of diverse experience in the U.S. and Europe. Electricity planning has not historically been a focus of U.S.- or EU-China energy sector collaboration. This analysis suggests that it should be.