Building on the European Green Deal, the European Commission has adopted a new business plan for Europe – the Clean Industrial Deal. The plan aims to address the “climate crisis and its consequences, competitiveness concerns and economic resilience.” A cornerstone of the plan is to improve energy affordability for European consumers. That means tackling Europe’s reliance on imported fossil gas – the main cause of higher and more volatile energy prices.

Beyond reducing dependence on fossil fuels, with the Clean Industrial Deal the European Commission aims to “increase economy-wide electrification rate from 21.3% today to 32% in 2030.” This is a welcome development. Electrification brings significant benefits. When coupled with the ever-growing share of renewables, it reduces the need for imported gas. Electrified energy uses also are usually more efficient in comparison with fossil-fuelled ones. This efficiency, together with renewable generation, also reduces carbon emissions and local air pollution.

The cherry on top is that electrification of industry can also support European competitiveness. Firstly, it can benefit European strategic independence by supporting the development of a European clean tech industry. Secondly, the European Investment Bank Investment Report 2024/2025 clearly shows that energy efficiency measures, of which electrification is one, lead to lower operational costs and increased profitability for businesses. Not only that, but “firms that have improved their energy performance experience substantial gains in profitability, total factor productivity, innovation and job creation.”

With this in mind, the European Commission has set an ambitious target and timeline. Accordingly, it is timely to start looking at where are the obvious places to electrify.

What is ‘light industry’?

The term ‘light industry’ generally covers industrial sectors characterised by lower capital costs alongside lower energy costs. This definition is in comparison with ‘heavy industry’ such as steelmaking or cement manufacturing. Examples of light industry include food, beverage and tobacco processing; textiles and leather; wood products; paper products; metal, electronic and machinery manufacturing; vehicle production; and construction.

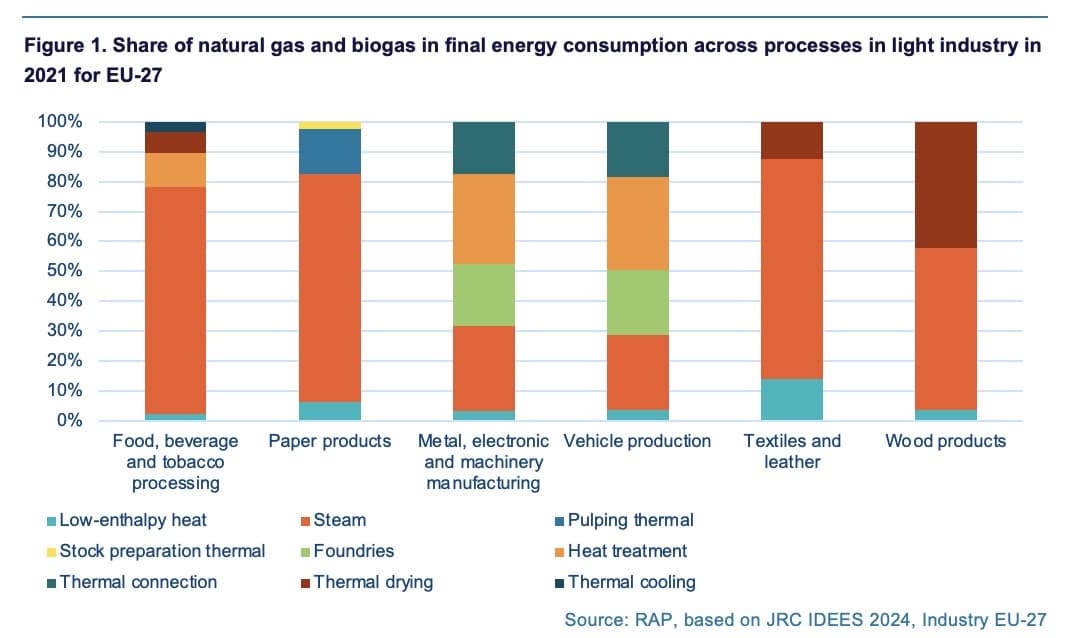

Within these sectors, for the most part, comparatively lower temperature processes are used. For example, an industrial bakery oven operates at a lower temperature than an iron foundry. While this is an extreme comparison, the Joint Research Centre’s Integrated Database of the European Energy System shows that the lion’s share of natural gas and biogas in light industry is used to generate steam. Across the three sectors of food, beverages and tobacco, paper products, and textiles and leather, over 70% of the final energy consumption of biogas and natural gas was for steam-based processes.

From the technological standpoint, several studies have looked at the potential for industrial decarbonisation through direct electrification. Their assessments show that the majority of light industry processes currently using fossil gas can be electrified with already established technologies. For example, space heating, water heating and steam generation can be done using highly efficient heat pumps. Should higher temperatures be required, electric boilers are another efficient solution. Resistance heating can replace burners for process heat and direct heat applications.

Of the processes used in light industry, a study by Agora Industry shows that some challenges remain in connection with welding and foundries; although these processes can also be electrified, they are at a lower stage of development.

Having established that light industries can be electrified, what is the potential impact of their electrification?

Back-of-the-envelope calculations on natural gas in light industry

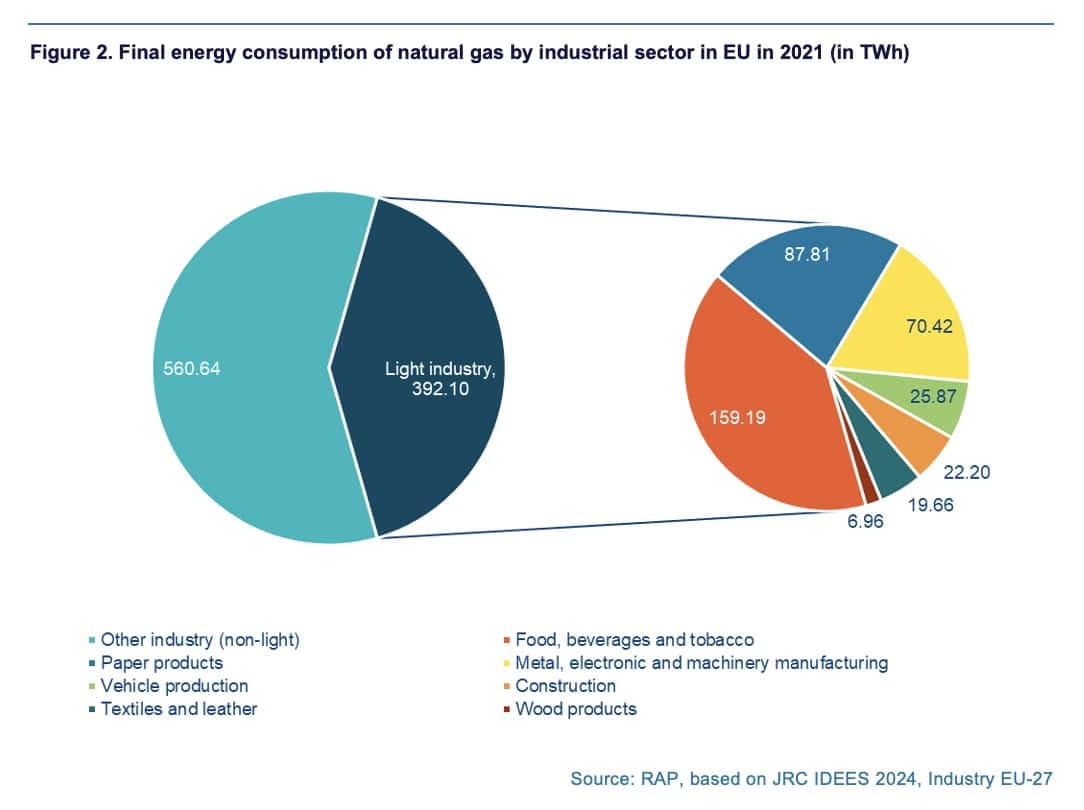

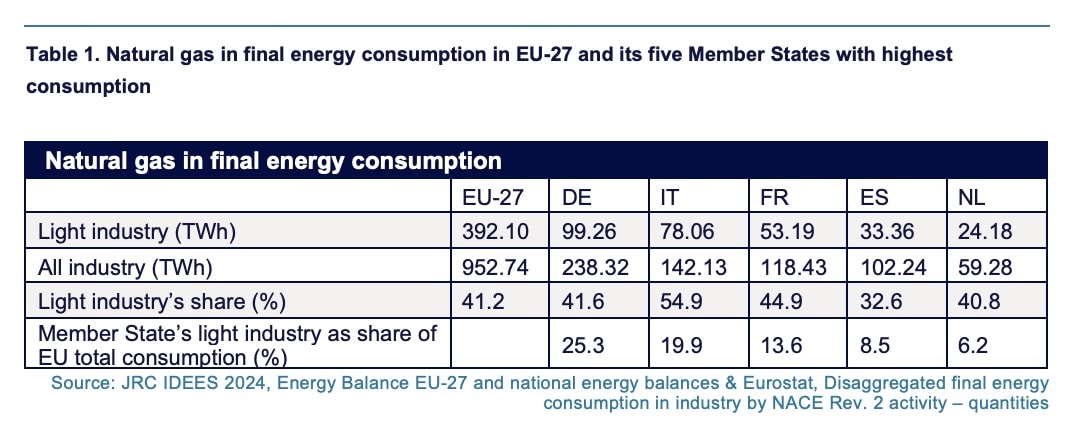

According to the Joint Research Centre’s database in the EU, in 2021, natural gas accounted for 952.74 TWh in the final energy consumption in industry, with light industry representing 41.2% or 392.1 TWh. The biggest share of consumption took place in the food, beverages and tobacco sectors with 159.19 TWh, followed by paper products with 87.81 TWh and manufacturing with 70.42 TWh.

The four countries with the highest gas consumption in light industry correlate, unsurprisingly, with the leaders in value of sold industrial production. Germany tops the list with 99.26 TWh of natural gas in final energy consumption in light industry, or 25.3% of the EU total. It is followed by Italy, with 78.06 TWh, almost 20% of the EU total.

More than 40% of the natural gas went towards light industry in EU Member States, as is shown in the table below. The two extremes are Italy (54.9%) and Spain (32.6%).

In essence, across European industry, light industry sectors are responsible for nearly half of natural gas demand. Considering that this demand can be electrified, the question is what is stopping progress and what can be done.

Unlocking electrification in light industry

The first challenge of migrating any business from fossil gas to electricity is the cost. New equipment and adaptation of existing processes require capital investments, while paying for electricity that is often more expensive than natural gas can limit the benefits of the transition.

In relation to capital costs, within the ongoing state aid revision under the Clean Industrial Deal, targeted action by Member States can increase access to capital. Earmarking national funds in the form of grants, loans or guarantees for electrification will facilitate investments, ideally also stimulating private investment. Furthermore, as these sectors are less capital-intensive, light industry might require smaller amounts of public funding for electrification yet have an outsized impact in terms of reducing fossil gas use, greenhouse gas emissions and local pollution.

Operating costs can be lowered through taxation reform, network charges and demand-side flexibility. On taxation, although the European energy taxation framework is not fit for purpose to deliver on the EU’s climate and energy objectives, Member States could lower the electricity to gas price ratio through environmental taxation or shifting levies. On network charges, introducing regulation to incentivise demand-side flexibility and distributed energy resources flexibility can enable businesses to be active participants in the energy system, potentially leading to savings on energy costs and generating revenue from delivering system services. Lastly, highly efficient heat pumps can bring down running costs compared to fossil fuels.

Another barrier to electrification arises from political uncertainty and lack of information. To address this, public authorities can partner with light industry sectors, grid operators and technology providers to develop electrification action plans to deliver on cost-effective decarbonisation solutions. A significant amount of public resources has been spent on developing hydrogen strategies across the continent, despite limited economic uses for hydrogen. It might be worthwhile to refocus these planning efforts on addressing electrification of light industry, through which effective decarbonisation can be achieved.

On a final note, the latest report from ACER on gas and electricity markets shows that replacing Russian gas with liquified natural gas does not solve the fundamental problems of the current European fossil fuel-importing energy system: “As an importer of gas, the EU is unlikely to reach price parity with exporting nations.” This means that European competitiveness will continue to be hurt. To address this, electrification is the name of the game. When coupled with the indigenous renewable energy, electrification can improve security of supply and competitiveness, while also lowering greenhouse gas emissions. In this regard, light industry is an easy win for gas reduction – it is easier to electrify than heavy industry and constitutes a significant share of European gas demand. Accordingly, the EU and the Member States now have an excellent opportunity to make the regulatory changes to deliver on the Clean Industrial Deal target of 32% EU-wide electrification.