Three trends in the power sector are converging to drive rapid and unprecedented change. State and utility climate goals are driving significant investment in clean energy. Fossil-fueled generation is aging and retiring at the same time that renewable energy and storage are increasing in efficiency and declining in cost. And increased electrification of end uses, including transportation and space and water heating, is allowing for demand-side flexibility that enables supply- and demand-side resources to complement each other.

Vertically integrated utilities are poised to spend at least $350 billion on power plants between now and 2030. But legacy procurement practices in most states are not poised to harness the three trends described above to take full advantage of next-generation electric systems and technologies. Such legacy practices are likely to result in suboptimal procurement outcomes. Flexible, clean and reliable energy optimization requires a next-generation approach to procurement, and a new report co-authored by RMI and RAP seeks to help regulators and utilities implement next-generation procurement practices.

Traditionally, procurement practices were designed to accommodate the limited needs and capabilities of legacy electric systems: Utilities delivered electricity from large, remote and inflexible power plants to passive households and businesses. This type of static generation will no longer meet the needs of utilities, customers, and states seeking to meet policy goals at least cost. Instead, states need an electric system where demand- and supply-side resources can be optimized on a flexible platform. Optimizing resources in this manner is feasible, but it will not happen without next-generation procurement, which allows these resources to be acquired in a way that enables their coordinated operation.

Legacy procurement practices are fundamentally flawed for several reasons. First, they often limit bids to a subset of available resources. For example, a utility request for proposals (RFP) might seek bids for only gas peaker plants, thus disallowing bids for Clean Energy Portfolios (combinations of solar, storage, and distributed energy resources), which can offer the electric services provided by a gas peaker plant while providing additional energy and non-energy benefits.

Second, legacy practices seldom specify the electric system need transparently, with the locational and temporal granularity required to attract optimized solutions. By failing to specify the actual need, utility procurement practices often favor inflexible fossil resources that may not optimally meet the specific need, while at the same time discouraging optimized portfolios of resource solutions. When utilities communicate the system need transparently with specifics of time and location, bidders can use the more diverse and flexible resource mix of today to offer targeted solutions to meet that need.

Finally, legacy procurement practices reward solutions to immediate system needs that often fail to identify “least-regrets” resource solutions that co-optimize system and environmental goals over a longer planning horizon. For example, investment in an inflexible, capital-intensive fossil project may meet near-term energy needs effectively, but may become obsolete before the end of the project’s physical life. A portfolio of resources may meet the near-term need while at the same time providing value to the end of its expected life. In such a situation, the latter resource is clearly preferable, and thus best-practice procurement evaluation should consider both near-term needs and longer-term needs in evaluating competing resource proposals.

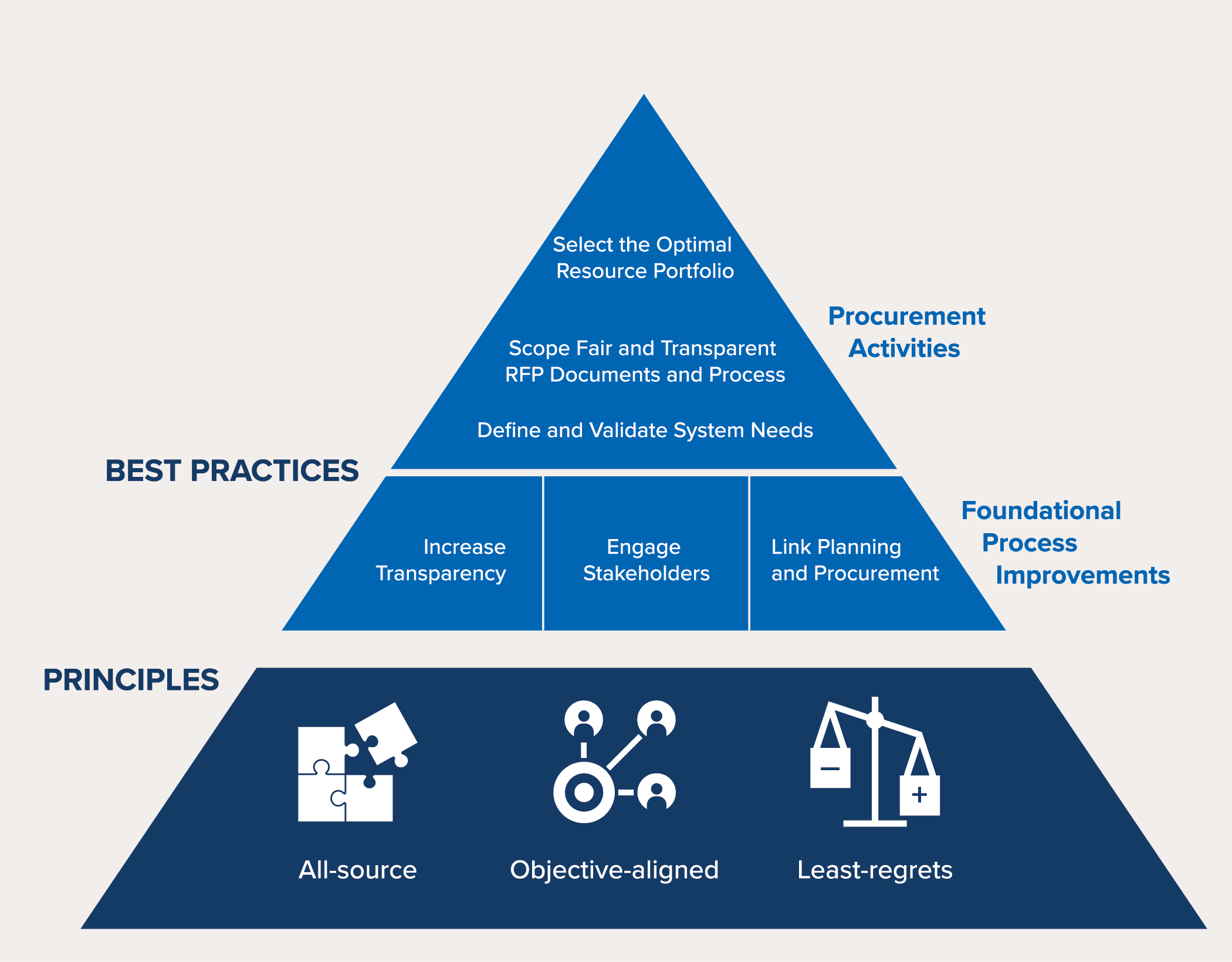

A next-generation approach offers fixes for each of the flaws described above and offers principles and best practices as illustrated in the figure below. The report explains all of the principles and best practices in detail and with examples where best practices have emerged. In this blog, we want to focus on what regulators can do most immediately to usher in a next-generation procurement paradigm — one that enables energy optimization to meet reliability and environmental goals at least cost over the planning horizon.

To enable next-generation procurement, regulators can jump -start their progress with four actions:

- Order utilities to transparently define and validate the system need;

- Implement a resource planning process that engages stakeholders, which can ensure that the system need is specific and placed in the context of system planning;

- Make modeling assumptions and tools as transparent as reasonably possible to all stakeholders to allow the system need to be further vetted and tested within the stakeholder process; and

- Align procurement RFP specifications with vetted resource planning outcomes.

Regulators can promote a beneficial competitive outcome by requiring bidding processes that are open to all who meet reasonable qualification requirements. Next-generation procurement initiates an RFP process that is transparent and fair to all bidders, where regulators allow all bidders to both design solutions to meet needs and to compete on a level playing field. Regulators should further ensure that the process allows bidders to offer all the capabilities their resources and resource portfolios possess. Finally, regulators should ensure that codes of conduct are established to ensure fair competition if the incumbent utility or an affiliate of the same holding company is allowed to bid on the solicitation.

Regulators should structure a next-generation procurement process so that the grid and societal values of resources are clear and transparent and can be applied to the evaluation of bids to select optimal solutions. Evaluation criteria should be transparent and clearly communicated to bidders well ahead of bid deadlines. Regulators may also want to require a third-party, independent evaluator to supervise utility bid evaluation to ensure that it is done in line with the established evaluation criteria.

Finally, next-generation procurement requires utilities to bring the best portfolios to a utility commission for consideration. At this point, regulators can exercise their discretion to consider trade-offs among bids, and if necessary, require additional modeling to determine the optimal portfolio to meet power-system and regulatory goals.

Regulators can navigate the difficult waters of emerging technologies and evolving business models by aligning procurement practices with their regulatory goals using next-generation procurement practices. The practical guide demonstrates to regulators that achieving this alignment will point the way to optimized system solutions, which are:

- All-source, to effectively utilize available resource options;

- Objective-aligned, to enable investments to address specific utility needs or state policy goals; and

- Least-regrets, to limit investment in suboptimal long-term solutions.