Experts see heat pumps as one of the main solutions for tackling the carbon emissions associated with keeping buildings warm, both in the UK and internationally. Yet sales of the technology, often likened to a fridge running in reverse, have remained stubbornly low in many countries.

The latest figures, collated in this article for Carbon Brief, show the tides beginning to turn, with sales in 2021 seeing double-digit growth in countries ranging from Austria to China.

While rapid growth in the market seems assured, heat pumps might still fall short of the levels required for a global pathway to net-zero by 2050, without further government action.

Highly efficient

Heat pumps are a low-carbon heating technology with the potential to deliver large-scale reductions in carbon emissions from building heat.

They use electricity to move heat from ambient outside air, water or soil to a building’s interior and to heat water. This process is highly efficient, with heat pumps delivering three to four units of heat for each unit of electricity needed to run them.

When the electricity used to drive a heat pump is produced from low-carbon sources, all this heat is also low carbon. It is this simple capacity to deliver heat very efficiently and cleanly that makes heat pumps a key technology in most pathways to net-zero.

The International Energy Agency’s (IEA) pathway to net-zero by 2050, for example, includes 1.8bn heat pumps in buildings in 2050 providing 55% of energy demand for heating globally. This compares with just 180m units installed today, providing 7% of heating.

Similarly in the UK, the most cost-effective Climate Change Committee (CCC) “balanced” pathway to net-zero sees the majority of homes being heated with heat pumps by 2050.

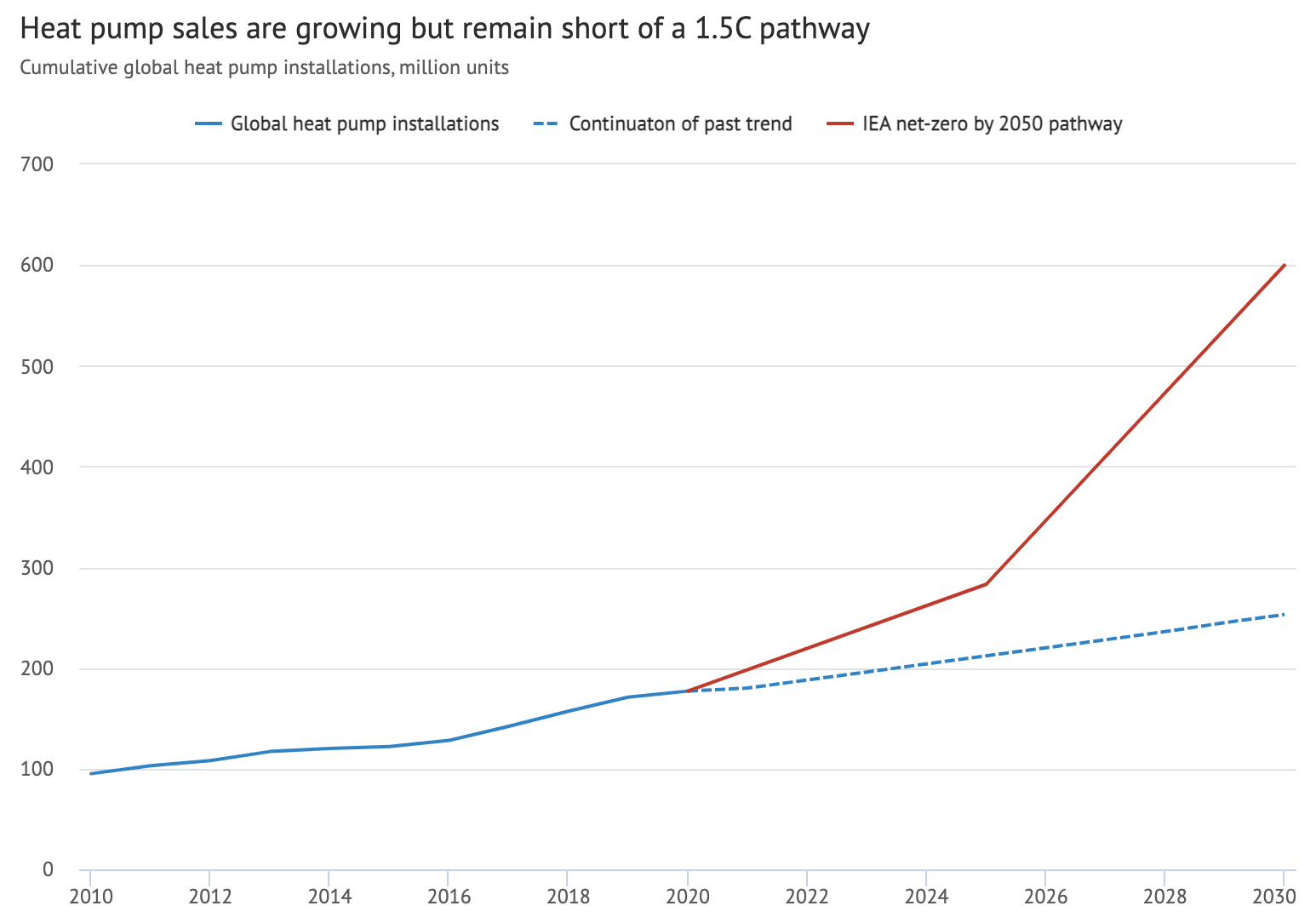

Until recently, however, the heat pump market has been growing far more slowly than required in the IEA or CCC scenarios. This is evident from the IEA’s global heat pump stock figures in the chart below, which shows that, at current trends, only 253m heat pumps would be installed globally by 2030, compared with the 600m units needed by that year in the IEA’s net-zero scenario – a shortfall of 58%.

Globally, just 177m heat pumps had been installed by 2020, according to the IEA’s data. Most of these heat pumps were in China (33%), followed by North America (23%) and Europe (12%).

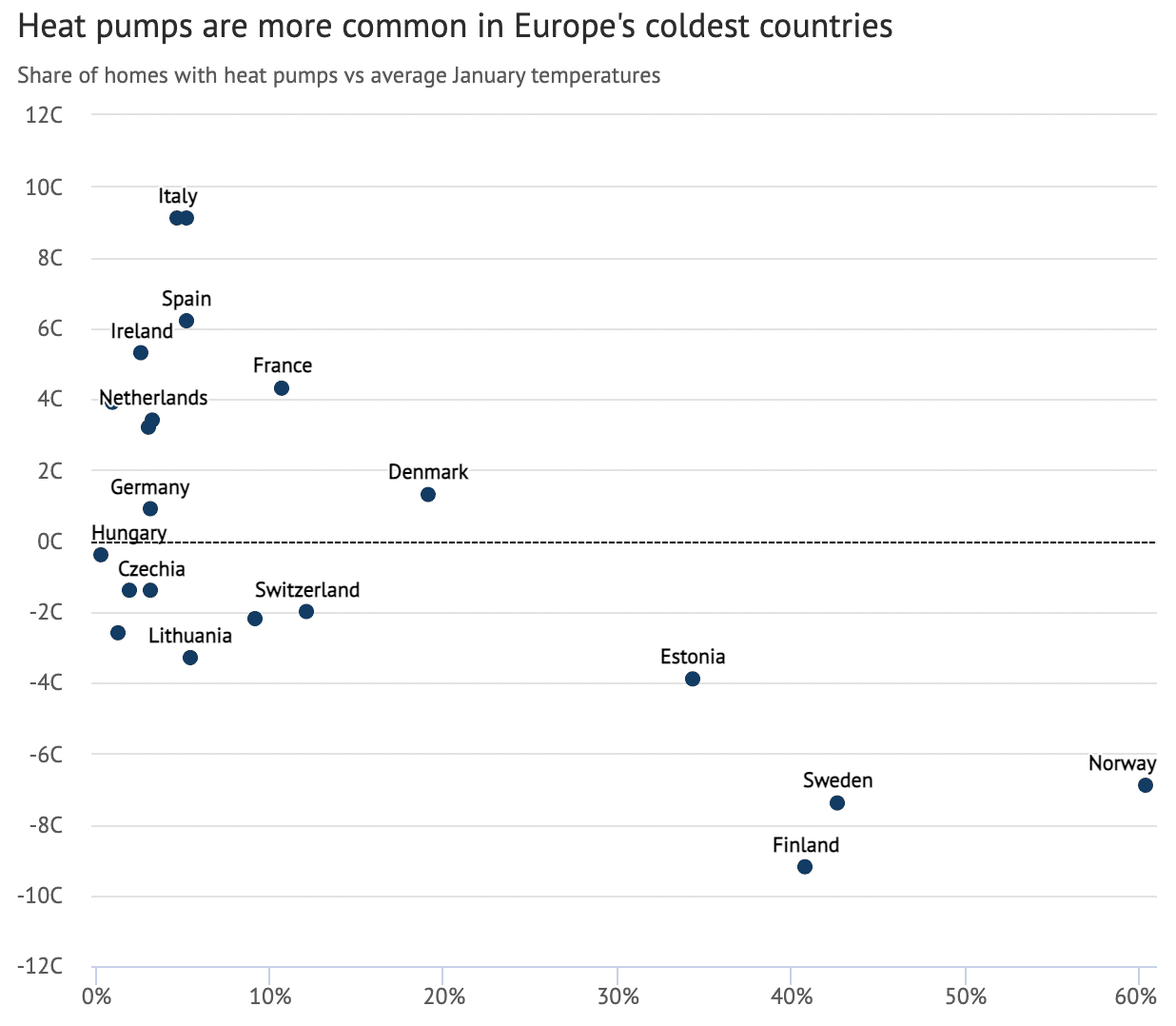

Interestingly, the highest penetration of heat pumps can be found in the coldest climates, as the chart below shows. In Europe, the four countries with the largest share of heat pumps are Norway (60% of households), Sweden (43% of households), Finland (41% of households) and Estonia (34% of households). These four countries also face the coldest winters in Europe.

Expanding market for heat pumps in 2021

The IEA data shows the global heat pump market grew by just 3% in 2020. Before that, the market had been growing by around 10% per year. The IEA’s net-zero pathway requires market growth at a global level of around 13%, year on year to 2030.

Following the slowdown in 2020, initial data suggests the heat pump market saw a strong recovery in 2021, with double-digit growth in some of the countries where figures are available.

Across Europe, for example, the European Heat Pump Association (EHPA) expects market growth to have exceeded 25% in 2021, hitting 2m units sold per year for the first time.

The Polish heat pump association Port PC reported an increase of 60% for heat pumps in 2021, mainly driven by regulations phasing out coal heating for single-family homes in the country.

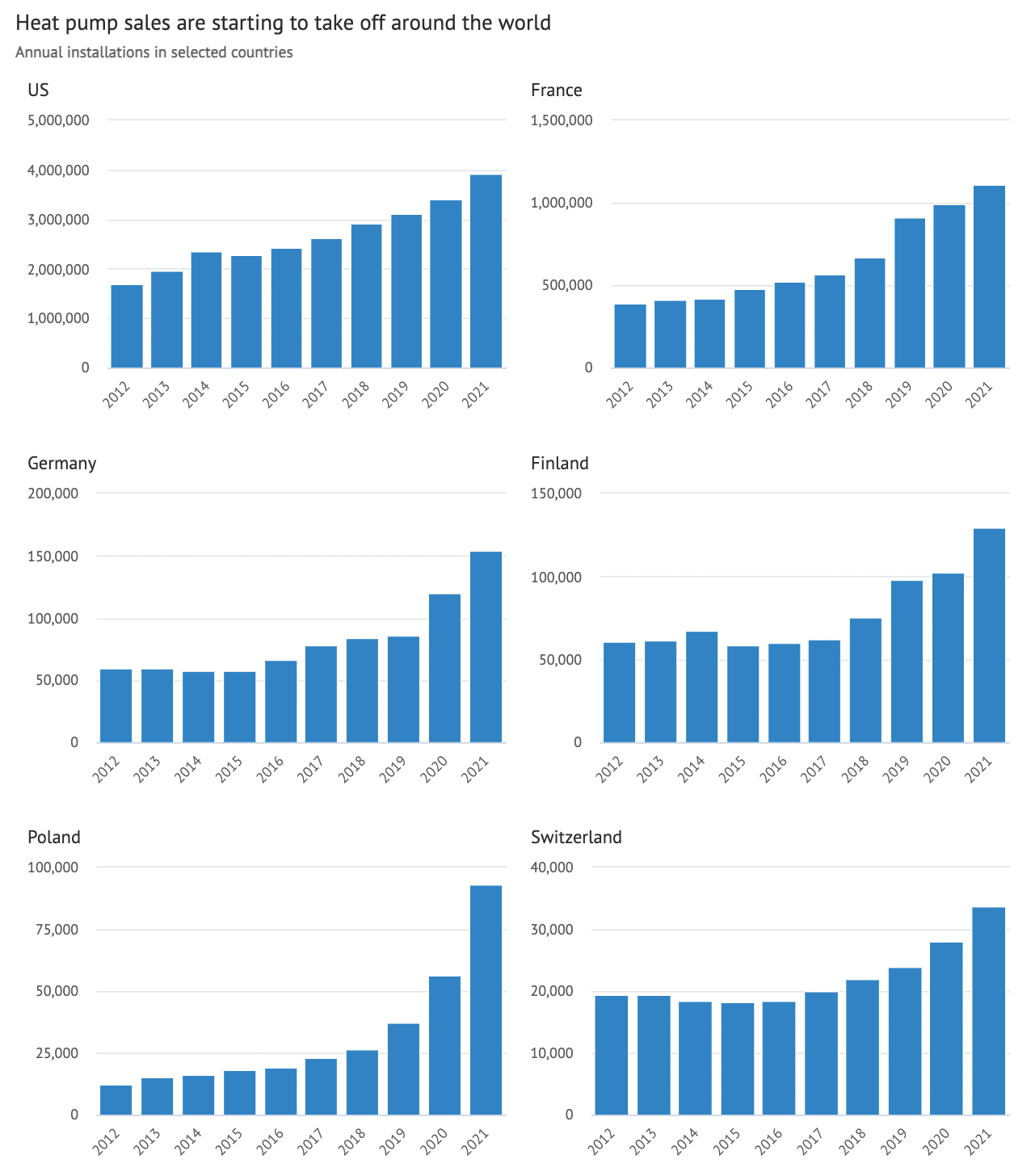

In Germany, the heat pump market grew by 28% in 2021, with 154,000 units sold – mainly because of the expansion of air source heat pump sales. The adoption of a carbon tax on heating fuels in 2021 partly explains the growth observed.

These figures are shown in the chart below, along with data for several other countries where data is available through to 2021.

The U.S., another global leader for air source heat pumps, gained 15% in 2021, capping a run of consistent yearly growth above 5% since 2015.

Finland showed similar growth to Germany in 2021, with an increase of 25% to 130,000 heat pumps installed, according to the Finnish Heat Pump Association. Given the small size of the country in terms of population, this is remarkable, with almost 5% of all homes installing a heat pump in 2021.

The majority of heat pumps installed in Finland were air-to-air heat pumps, which can also be used for cooling. However, the Finnish Heat Pump Association estimates that air-to-air heat pumps used for cooling account for only 10%-15% of the respective market.

What is notable about Finland is that the heat pump market only started to expand in the mid-2000s, with cumulative installations now exceeding 1m units.

Overall, the French heat pump market grew by 3% in 2021, but the air-to-water segment rose by 53%. The French heat pump market is the largest in Europe, with more than 1m units in 2021. By far the most important type of heat pump in France are air-to-air heat pumps.

Switzerland, another mature and long-established market for heat pumps, showed market growth of 20% in 2021, mostly air-to-water systems. More remarkable is the fact that 54% of all heating systems sold in Switzerland last year were heat pumps, making it the dominant heating technology not only in new buildings but in existing buildings too.

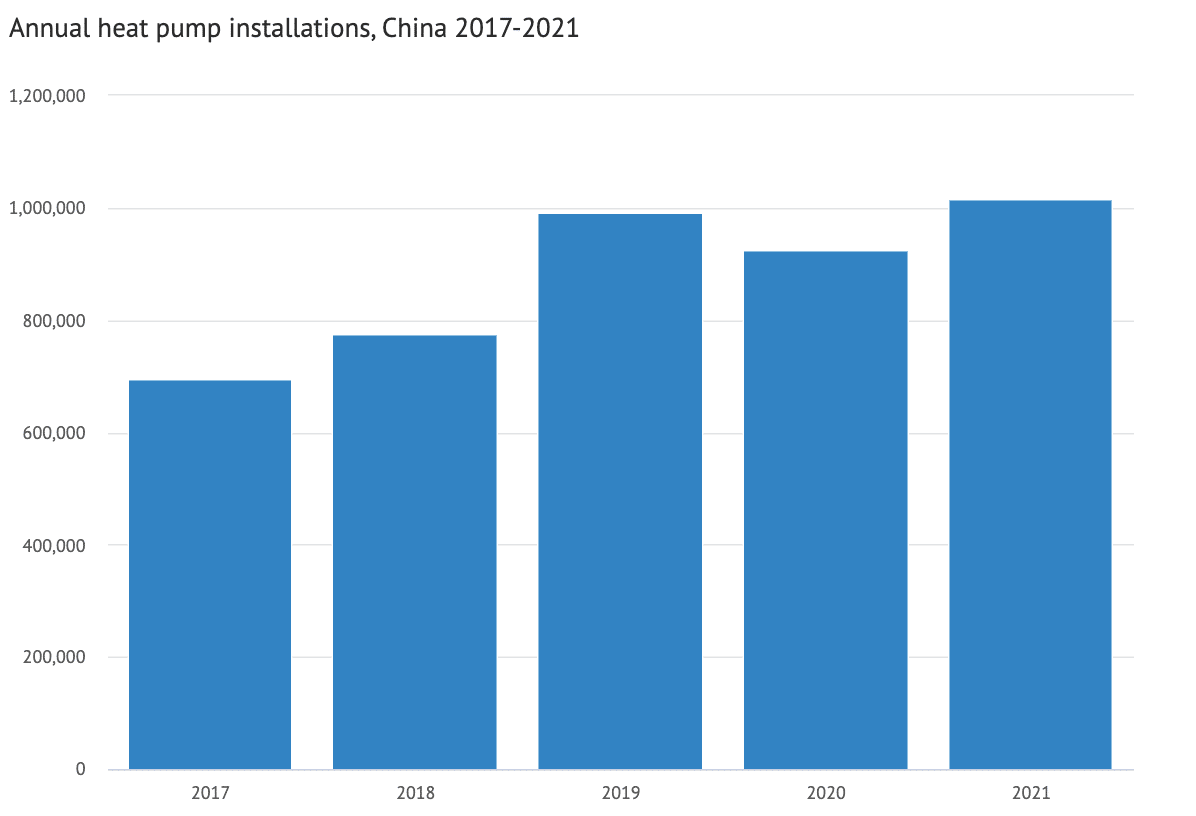

In China, initial estimates of residential air-source heat pump sales in 2021 saw market growth of 10% to more than 1 million units, for the first time, with hints of even larger growth in non-residential sales.

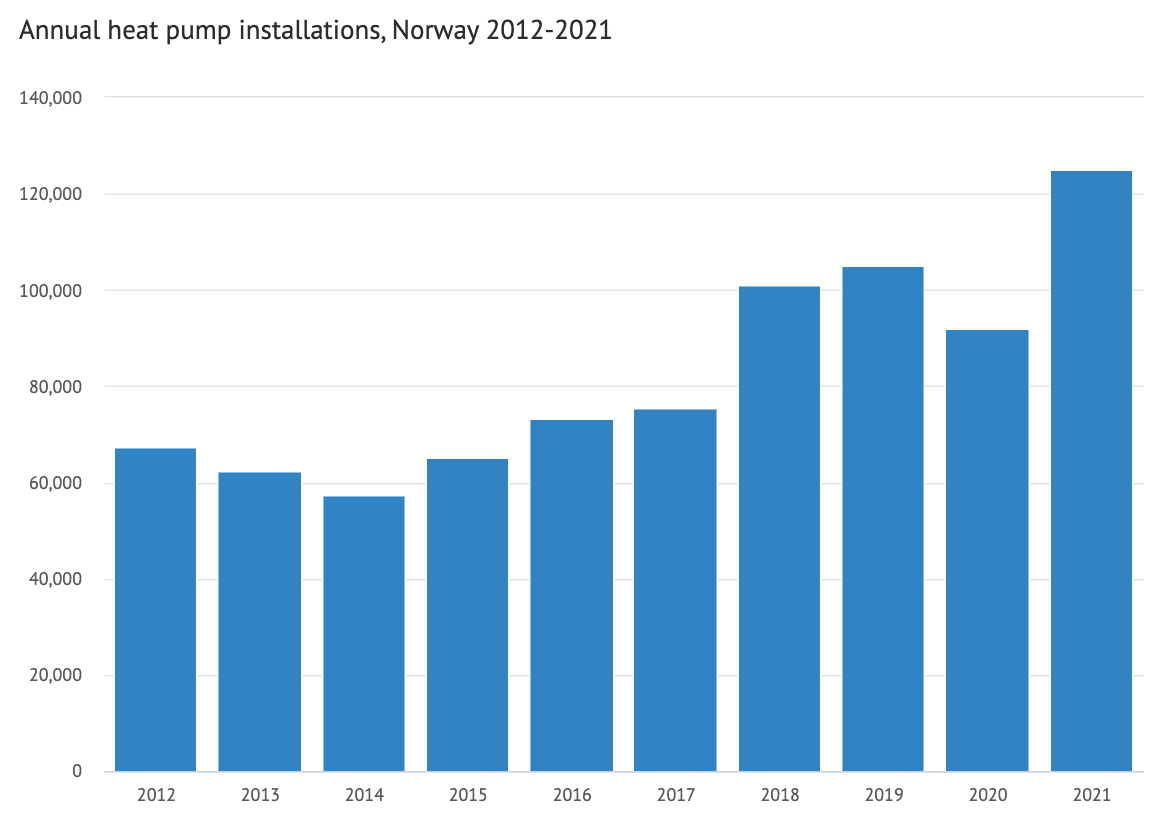

In Norway, a total of 125,000 heat pumps were sold in 2021, a similar amount to Finland. This represents growth of 36% compared to 2020. Also similar to Finland is that the majority of heat pumps sold in Norway are air-to-air heat pumps.

Outlook for heat pumps

Although further rapid growth now looks likely, the pace of adoption – and how that measures up against pathways to net-zero – will depend strongly on government policies and energy price trends.

The recent increase in European and Asian gas prices makes heat pumps financially more attractive than gas boilers, as previous analysis shows. But that could change, which is why policy remains key and initiatives are underway to provide more support for heat pumps.

In the EU, for example, the European Green Deal and the associated push for decarbonising heating through a variety of directives means the market for heat pumps will double to 4m installations per year, according to the EHPA.

Drivers include a European Commission proposal to extend the EU Emissions Trading System to heating fuels, which would improve heat pump economics relative to oil-and-gas heating.

There is also new regulation in various European countries banning or limiting fossil-fuel heating, not only in new buildings but also increasingly in existing buildings.

For example, the new German government has announced that from 2026 all new heating systems must run on at least 65% renewable energy. Others such as Norway, Sweden, Denmark and Finland have announced explicit or implicit bans of new fossil oil-based heating systems in all buildings.

The Netherlands no longer allows new homes to connect to the gas grid, while Ireland, Flanders (Belgium) and Austria have announced bans on oil boilers for new buildings.

Ireland recently unveiled a €8bn scheme that nearly doubles the value of grants for heat pumps as the country looks to ship 400,000 heat pumps into homes by 2030.

In the UK, the government is consulting on requiring manufacturers of heating systems to sell an increasing number of heat pumps and has announced an “ambition” to phase out gas boilers by 2035. It will also launch a new heat pump grant scheme in April.

China has a track record of using clean heat solutions to reduce air pollution from coal boilers. Its southern provinces have high market potential for heat pumps, with areas such as Beijing already offering incentives.

Despite these local incentives and programmes, however, heat pumps lack support at the national level in China. For example, they are not classified as renewable by the national government, meaning they do not benefit from a clean heat subsidy available in the northern provinces.

In the U.S., a drive to electrify homes – and, in some areas, ban fossil fuel heating – is expected to further boost the prospects for heat pumps. The stalledBuild Back Better plan included a 10-year $3.5bn rebate program for electric homes with up to $4,000 for heat pumps, among other incentives.

The Biden administration has also launched a National Building Performance Standards Coalition, a task force comprising 33 state and municipal governments, that aims to “unlock energy efficiency and electrification across the buildings sector.”

Double-digit growth in major heat pump markets during 2021 shows powerful momentum. But without the continued expansion of policies to support their rollout, heat pump deployment will fall short of the level needed to reach net-zero by 2050 – and to limit warming to 1.5C.

Duncan Gibb is the lead analyst on heating and buildings at REN21.

This article originally appeared in Carbon Brief. Graphics by Joe Goodman for Carbon Brief.