The electricity sector in India has experienced an evolution of sorts throughout the years. Since the early the 1990s, the sector has grown from a vertically integrated monopoly with generation, transmission, and distribution all under one roof, to the current structure in accord with the Electricity Act of 2003 where the three have been unbundled and now operate separately. The Bureau of Energy Efficiency (BEE) has made substantial progress towards promoting end-use efficiency with more than 15% savings demonstrated in the appliance-level energy use with its labelling and standards plans. The Indian power sector has created a conducive environment for renewable energy generators: as of 31 January 2022, renewables constituted 26.8% of the nation’s total installed capacity of 370 GW. The politics of subsidised or free electricity to a certain category of consumers, a legacy practice followed by the distribution companies (discoms), puts undue pressure on the entire power sector’s financial health.

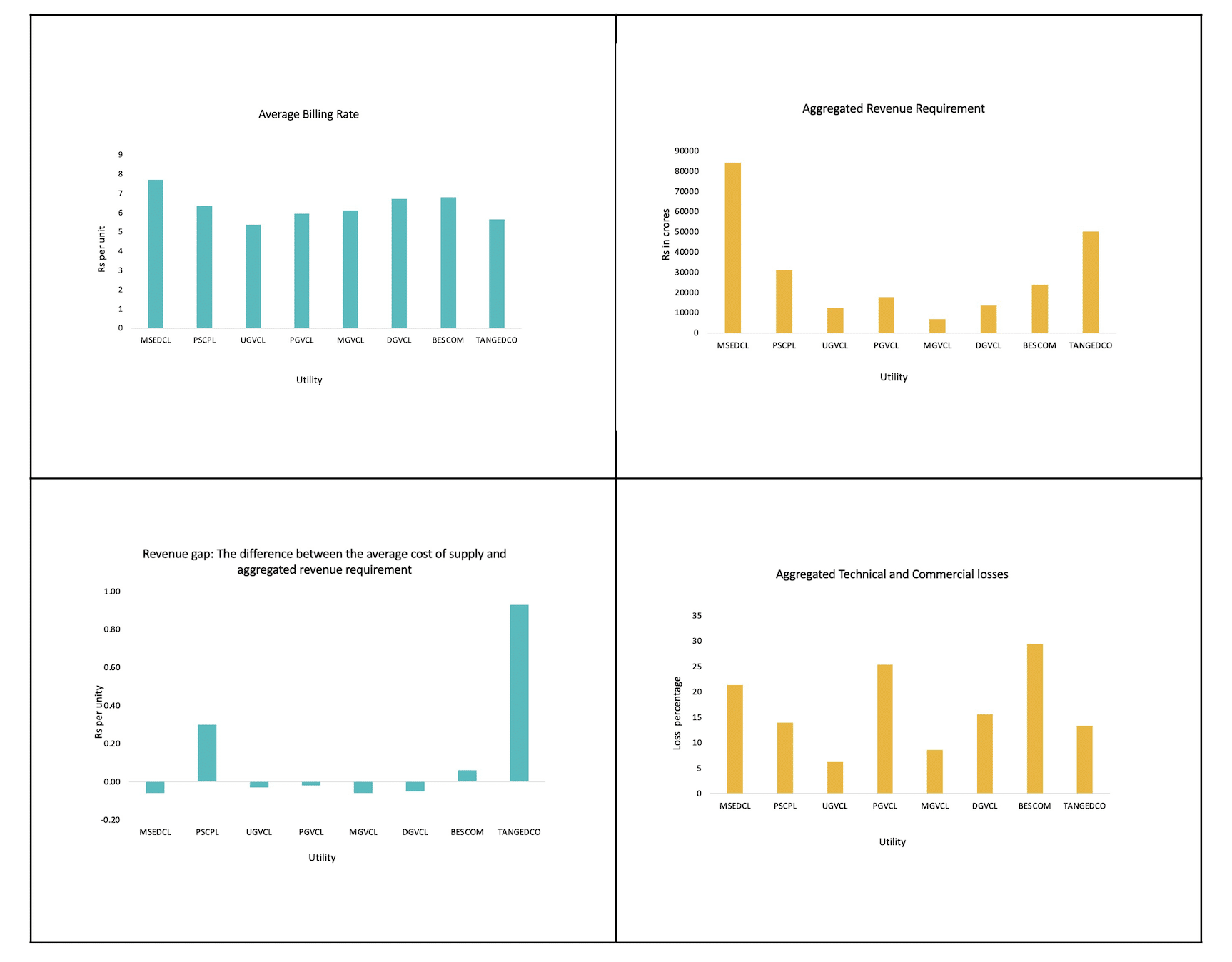

The four charts below show Average Billing Rate (ABR),* Aggregated Revenue Requirement (ARR),** revenue gap (difference between the average cost of supply (ACS) and ARR, and Aggregated Technical and Commercial (AT&C) losses for discoms in major states.***

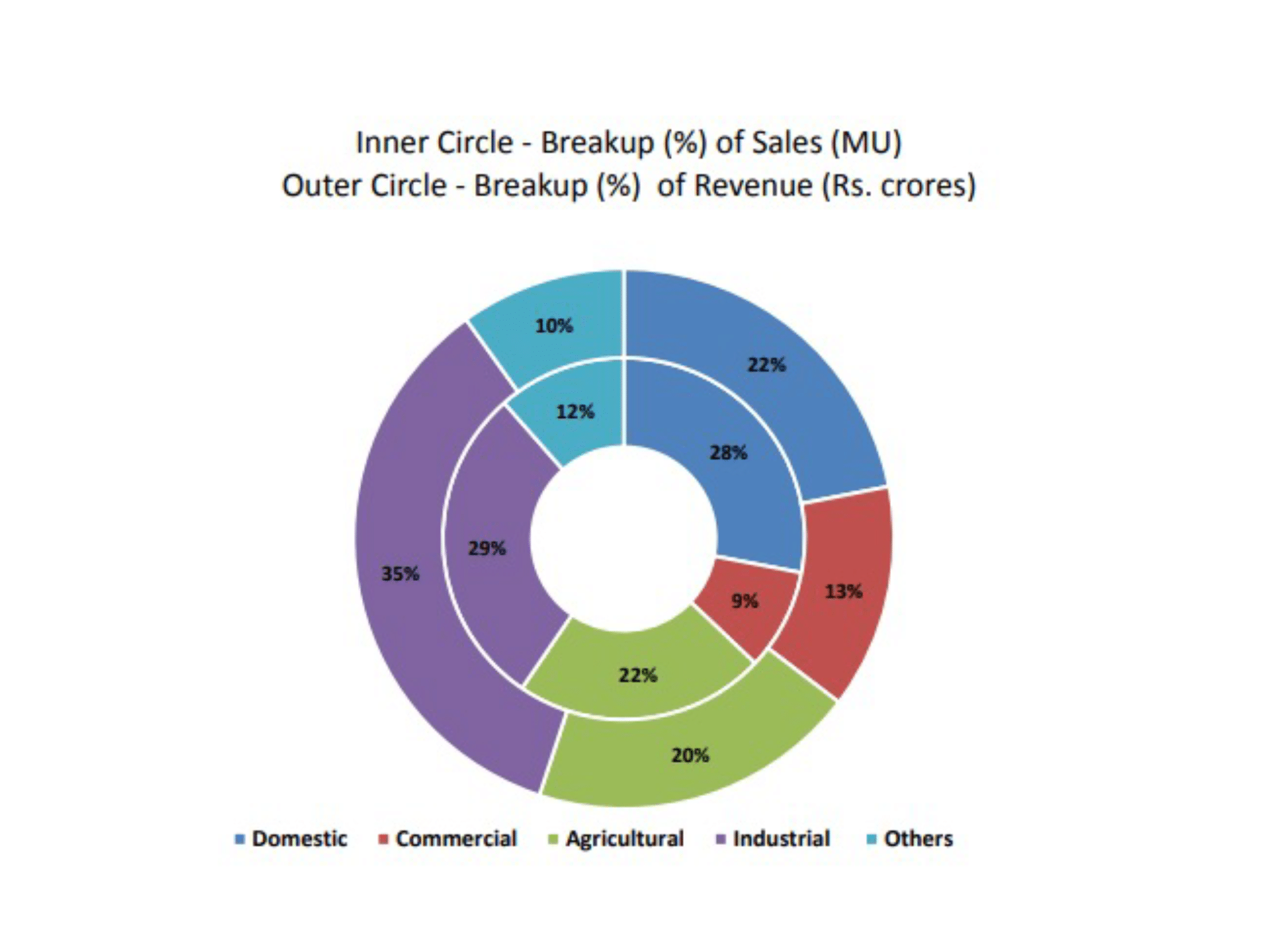

The distribution sector in India is also struggling. As of March 2021, the sector owes over INR 85,000 Crores (approx. U.S. $12 billion) to the generation companies. Discoms depend on the commercial and industrial (C&I) consumer base to subsidise the agriculture and the low-volume domestic customer classes, as seen in the difference between energy sales and revenues in the figure below.

Source: PFC, 2019

The C&I consumers will continue to provide the lion’s share of discom revenues, even if they take advantage of “open access” (the freedom to buy power from sources other than the incumbent discoms), because they are nevertheless required to pay high cross-subsidy surcharges and wheeling charges (power distribution charges). It’s important to retain such consumers within the incumbent discoms with key objectives of promoting higher renewable energy shares in the power mix, as well as reducing the electricity use with a deeper portfolio of energy efficient end-use practices. The discoms’ heavy dependence on C&I consumers to generate sufficient revenues creates significant barriers to decarbonisation investment opportunities among these consumers.

C&I consumers have an intrinsic need to reduce their power costs. Open access is a powerful opportunity for these consumers. So too are on-site efficiency and distributed resources, but such behind-the-meter investments are not encouraged by the discoms, given the threat of reduced revenues that they pose. Along those same lines, behind-the-meter generation (rooftop photovoltaic) within the consumer base is not easy to implement without on-site storage options or net metering/renewable energy export opportunities provided by the discoms. In several states, net metering policies do not favour the consumers creating large capacities to be exported to the grid beyond their diurnal requirements. It’s also opportune to deepen the behind-the-meter renewable energy and energy efficiency portfolio, combined with the storage solutions, at the consumer categories that are heavily subsidised.

One key opportunity to be explored in creating a substantive renewable energy, efficiency and storage portfolio on both sides of the meters is the possibility of discoms doubling up to become new energy service providers as much as legally possible. We hypothesise the possibility of developing a stronger efficiency, renewables, demand-responsive, end-use consumption, with adequate thermal and battery storage solutions at the consumer-side of the meter amongst all the customer categories.

Our team is currently exploring the efficacy and benefit-costs of discoms and consumers co-investing in behind-the-meter efficiency, dispersed solar, storage and demand-responsive end-use consumption patterns. We’re also researching in detail the regulatory regime that allows such investments, the benefit-costs of making investments in the behind-the-meter efficiency and renewables assets, and existing enhanced power sales opportunities through the possibility of selling saved energy for newer uses, such as electric vehicles. Other key benefits of enhanced renewable energy assets on the customer side of meter is the possibility of exporting renewable energy sources to other regions through an aggregated sale on the exchanges. More to come.

*ABR is calculated as ABR = Revenue expected from all categories million Rs /Approved sales in MU. The data has been obtained from the latest ARR of the respective utilities.

**This is the approved ARR for the upcoming year for the respective utilities.

***Discom key:

- Maharashtra: MSEDCL

- Punjab: PSCPL

- Gujarat: UGVCL; PGVCL; MGVCL; DGVCL

- Karnataka: BESCOM

- Tamil Nadu: TANGEDCO