E-commerce has grown significantly during the COVID crisis, recording a 15% increase in activity and delivery traffic in urban areas between 2019 and 2021. Replacing diesel delivery trucks with battery-electric trucks can help cut harmful emissions and local pollution and reduce noise levels from last-mile delivery.

Given their low daily driving ranges of 50 km on average and predictable schedules, urban delivery trucks present a promising segment for electrification. The high upfront cost of these vehicles, however, has been one of the main barriers preventing logistics companies from electrifying their fleets. Research by the International Council for Clean Transportation (ICCT) and the Regulatory Assistance Project (RAP) shows that these vehicles are in fact already cheaper to use than diesel trucks in four of six major European cities, when factoring in current purchase subsidies.

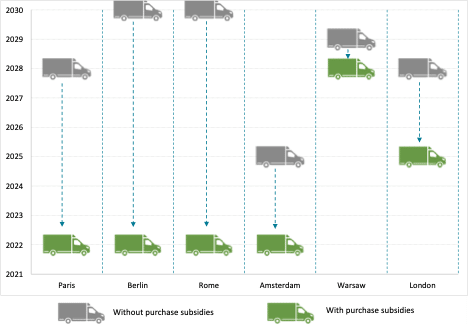

Electric trucks can reach cost parity with diesel trucks in 2022 in some cities, with purchase subsidies

To scale up the market for battery-electric delivery trucks, well-designed policies combining income-neutral government purchase subsidies, local emissions charges and smart charging requirements will help to put the cost advantage of electric trucks on solid footing. This in turn can accelerate the transition to electric fleets. ICCT and RAP unpack these three solutions based on their first-of-its-kind primary data analysis comparing six European cities: Paris, Berlin, Rome, Amsterdam, Warsaw and London.

Battery trucks need sustainable purchase subsidies to scale up electric delivery

Current purchase premiums help electric trucks compete with their diesel counterparts in major markets, but these subsidies are mainly financed by governments and, therefore, are not fiscally sustainable.

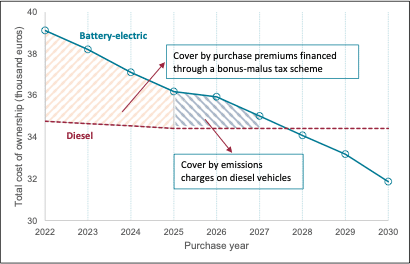

A solution already implemented for passenger cars in some EU countries is the bonus-malus tax scheme, which incentivises operators to buy an electric truck with a purchase premium financed by a tax imposed on newly registered diesel trucks. For electric trucks registered in 2022 in Germany, a bonus of €6,000 ($5,930) would be sufficient to cover the five-year gap in the total cost of ownership parity compared to diesel trucks. This bonus would be funded by an additional tax on diesel vehicles registered that year, with the maximum fee ranging from €700 to €2,500, depending on the sales share.

Purchase premiums and emissions charges help electric delivery vehicles reach cost parity in 2027 in Paris

Zero-emission zones and small emission charges for diesel trucks accelerate cost-parity threshold

Emissions charges on diesel delivery trucks are an efficient complementary policy to make the use of electric trucks more attractive for delivery companies. Our analysis shows that cities implementing an emissions charge between €2 and €4 per day, per vehicle in low- and zero-emissions zones will help electric trucks achieve cost parity before 2025, without any additional purchase premiums. If the charge is increased to €6 per day, electric trucks are the better economic choice today, without any other subsidies. Small emission charges generate disproportionately high benefits for fleet electrification. Across Europe, 250 cities have introduced low- and zero-emission zones to improve their air quality, with Amsterdam and Paris planning zero-emission zones for 2030.

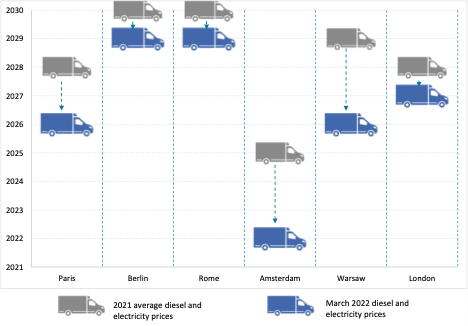

Despite current high power prices, electric trucks are a reliable choice for operators

Getting a complete picture of costs to run an electric truck can be challenging. Fleet operators not only need to estimate the costs of using electric trucks for delivery operations, but also the costs related to energy and grid use when charging them at the depot. In times of crisis, power prices may be considered a high cost factor. However, our analysis shows that, in March 2022, when electricity prices doubled and diesel prices increased by 60% relative to 2021 prices, electric trucks would become economically attractive one to three years earlier than if the 2021 prices applied. This is due to the higher efficiency of electric power trains, which need less energy for the same mileage, thus making battery-electric solutions less sensitive to price fluctuations than diesel-fuelled vehicles.

Cost parity is in sight, even with high electricity prices

An additional cost that is hard to estimate for operators – and is therefore often ignored by other studies – is the cost of using the power grid. This can vary between locations depending on whether truck charging is managed. Electric delivery trucks, depending on the company’s schedule, can be parked for up to 12 hours overnight at the depot. Charging them ‘smartly’ at this time increases the chance the fleets’ electricity demand remains within the depot’s overall installed capacity at all times. By not adding to its peak consumption, expensive upgrades to the depot’s grid connection can often be avoided. To help operators optimise charging and save cost, time-varying electricity and network tariffs are needed to give operators price signals about when it is most beneficial to charge their trucks. Analysis of primary data from six depot locations across Europe showed these costs can vary by a factor of four, depending on how tariffs are structured and whether they offer opportunities for smart charging.

A policy window to equip urban logistics depots for smart truck charging

Delivery trucks will charge mainly at the depot and truck volumes are expected to grow significantly in the second half of the decade. The current revision of the European Energy Performance of Buildings Directive can accelerate the buildout of charging infrastructure for logistics depots by requiring new and renovated depots and freight centres to install “smart” charging points for commercial vehicles. Including requirements to set up charging infrastructure at commercial depots with public access in the new Alternative Fuel Infrastructure Regulation is another opportunity to advance charging infrastructure. Finally, the New EU Urban Mobility Frameworkoffers the chance to address charging equipment and depot connections as part of local urban planning.

Electrifying logistics in urban areas is an easy win

Electrifying last-mile delivery is an obvious choice in the context of energy crises and the urgent need to make energy use more efficient. With increasing availability of different models, the business case is becoming more and more promising, in particular if helped by purchase incentives and local emissions charges on diesel trucks. These measures, in addition to equipping logistics depots with charging infrastructure, present a package that will help to drive electrification in a growing segment.

A version of this article originally appeared on Energy Monitor.