The COVID-19 crisis is influencing every aspect of the global economy, and electric utilities are certainly seeing significant impacts. Before utility regulators take actions to adjust revenues or rates to reflect COVID-19 impacts, it is important to identify and quantify the broad range of impacts so that those that increase costs or reduce sales can be appropriately offset against those that decrease costs or cause increased sales in some sectors.

The most easily quantified impacts are:

a) Lower commercial sales (with much of the commercial sector closed in March and April);

b) Higher residential sales (as people are home more); and

c) Lower fuel and purchased power costs (due to the decline in loads and in natural gas prices).

But there are many others. These include, for example:

d) Lower revenues from a disconnection moratorium imposed by most states;

e) Improved load shapes, from the reduction of daytime peaking commercial activity;

f) A sharp drop in interest rates, and thus in the cost of debt and equity capital;

g) Changes in labor costs, both up and down;

h) Increases in accounts receivable, and ultimately uncollectible accounts;

i) Adjustments to utility capital improvement programs across all sectors — generation, transmission and

distribution; and

j) Possible acceleration of deployment of advanced metering infrastructure, to reduce the future exposure of utility employees to occupational hazards.

The purpose of this blog is not to attempt to quantify these impacts for any utility; that is the job of utility regulators, with access to extensive data and adequate time to properly consider evidence. The purpose is simply to point out that many of these are offsetting impacts, so that the utility rate adjustments required may be smaller if applied simultaneously than if individual elements are applied to separate rate adjustments over the coming year.

The response will be different for regulators in vertically integrated states and for those in restructured states. And the response will be different for regulators implementing revenue regulation (decoupling) or performance-based regulation (PBR) mechanisms.

Sales volumes

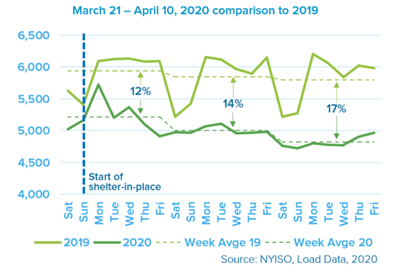

Most utilities are experiencing sales volume declines, primarily in the commercial sector, as office and retail workers have stayed home. For example, Figure 1 shows loads in New York City for a three-week period:

Figure 1: Electricity Consumption for New York City [1]

There are two obvious impacts visible in this simple graphic. First, total sales are lower. Second, the difference between weekday and weekend loads is much smaller, with most office buildings closed. This shows only daily sales, not hourly sales, so one cannot reach conclusions about the daily load shapes, but there is certainly reason to investigate whether the flatter day-to-day load shape is also reflected in a flatter hour-to-hour load shape.

This reduction in sales volumes will bring a reduction in revenues. Depending on the rate structure (customer charges, demand charges and energy charge blocks, e.g., time-varying or inclining block), the impact will vary from utility to utility. But the improved load shape from lower commercial activity will likely result in a significantly lower average cost for power supply, per kWh, as high-cost resources are left idle during weekday hours.

Many utilities have rate designs that limit their revenue loss in response to short-run variations in commercial and industrial sales. Demand charge “ratchets” apply a demand charge each month based on the highest demand reached in the past year. These are put in place specifically to offset the high systematic risk of the large commercial and industrial sectors (which add a premium to the utility cost of capital compared with more stable residential revenues). Some industrial customers are seeking regulatory relief from demand charges and demand ratchets, as these result in high bills during time of curtailment of production. [2] Where demand charge ratchets are in place, the growth in residential sales may generate far more incremental margin than the loss of non-residential sales. [3]

Fuel and purchased power costs

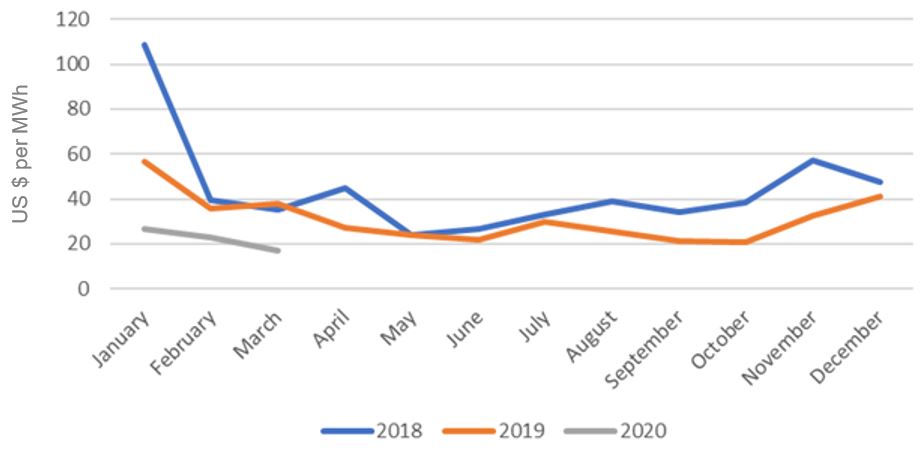

Even without COVID-19, some fuel costs were declining in response to an oil price war between Saudi Arabia and Russia, launched at the beginning of the year. But the sharp drop in electricity and industrial demand for natural gas has sharply depressed the price of gas, the most common fuel for electricity generation.

Figure 2: Henry Hub Natural Gas Spot Prices, November 2019–April 2020 [4]

These lower fuel prices also result in lower market-clearing prices in electricity markets, affecting both utilities buying power for load, and for customers that have elected real-time pricing in competitive market states. Some utilities may depend on wholesale sales of power, which may be depressed. For example, the graphic below compared ISO-New England prices for the first three months of this year compared with the previous two years.

Figure 3: Wholesale Electricity Prices in ISO-New England, 2018-Present [5]

Fuel and purchased power cost changes are typically passed through to consumers quickly, within a few months. A few states apply these changes only annually, and others only after a general rate case. Without any other elements being flowed through quickly, many utilities may be obligated to flow through rate reductions (from fuel and purchased power costs) even as they are experiencing revenue attrition (from sales declines). In restructured jurisdictions, default or standard service is often procured on a six-month basis for residential customers, but more frequently for commercial and industrial customers. Competitive supply and aggregations may have longer-term pricing structures.

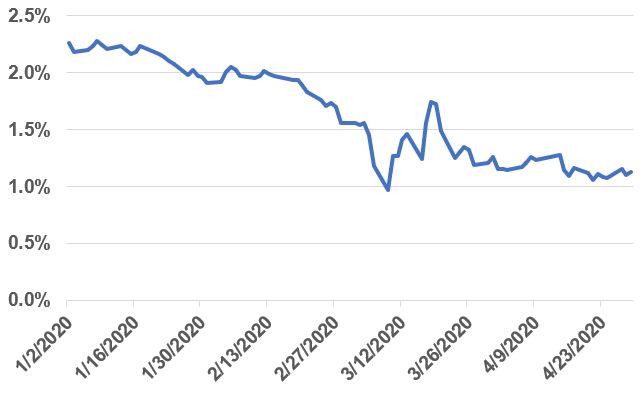

Cost of capital

Interest rates have dropped sharply in a “race for safety” by investors. Federal one-year and 10-year interest rates have dropped to near-zero levels. Utilities have immediate access to this lower-cost capital for their short-term debt and may be able to refinance longer-term debt at lower rates as well.

Figure 4: Ten-Year Treasury Interest Rates [6]

In the past decade, utility bonds have carried a premium of 200-400 basis points over the 10-year treasury interest rate, and utility returns on equity have approximated a premium of 500-700 basis points over the 10-year treasury interest rate.

Pragmatically, any business generating any profit is relatively more desirable to investors today than in December. Utility share prices have dropped, but this is quite possibly due to an expectation that they will suffer earnings attrition related to the crisis, and those losses will not be fully recoverable from electricity consumers.

Labor and other operation and maintenance costs

Some utilities will experience labor cost increases, as they may experience lower labor productivity due to “work from home” programs, and otherwise adapt to the need to provide for the health and safety of their employees. Regulators should be prepared to examine these cost increases for prudence, but many of these costs will no doubt be reasonable. However, with lower occupancy, building operating costs may be greatly reduced, which will tend to offset any labor productivity issues. And entire program areas may be reduced, from software development to tree trimming, achieving significant net reductions in overall operation and maintenance (O&M) expenses.

The lower electricity consumption we are experiencing should mean that entire power plants can be temporarily (or perhaps permanently) closed, thereby avoiding ongoing labor costs for those units. There is evidence this is occurring — coal consumption is down sharply, and in many places, this means that power plants are being idled.

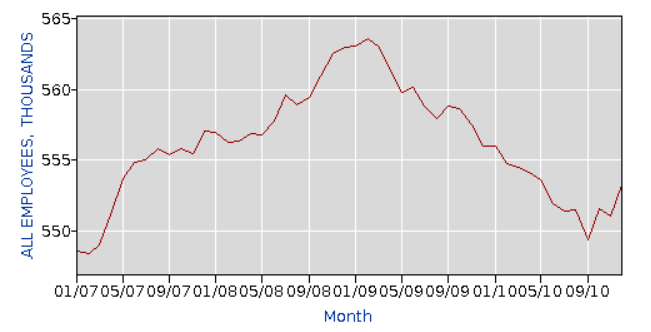

In addition, many utilities, in response to sales attrition, will impose hiring freezes, eliminate overtime work and even furlough employees in non-critical positions to conserve cash and preserve earnings. During the 2008-09 economic contraction, utility labor forces dropped by an average of about 3% (and was much higher for some hard-hit utilities).

Figure 5: Utility Sector Employment in the Great Recession, 2007–2010 [7]

That pattern is being repeated: Data from the U.S. Bureau of Labor Statistics show a decline of about 3,000 workers in the utility sector for March 2020 compared with March 2019. Indeed, on April 29, DTE (a utility serving the Detroit area), announced a $60 million O&M spending cut. [8]

Regulators should bear in mind that labor costs are variable, not fixed, costs when considering the overall impacts on utilities of the current contraction in sales. Regulators should examine changes in the labor costs of utilities seeking rate adjustments, to ensure that all known reductions are also reflected.

Accounts receivable

Many states have imposed disconnection moratoriums, and some have suspended late fees and interest charges for non-payment. These will tend to increase utility accounts receivable, and ultimately increase uncollectible accounts. If the recession deepens and extends over a year or more until a vaccine is developed and availability becomes widespread, these amounts may be significant. This will be offset by better public health than would occur if power were disconnected, but those benefits do not accrue directly to utilities.

Capital construction programs

Most utilities have extensive capital construction programs, which create a need for additional capital, derived from retained earnings, depreciation accrual, bonds and equity issuance. For many utilities, these programs will be adjusted in the wake of COVID-19, even if only due to unavailability of materials, contract management, subcontractors and skilled labor.

There may be opportunities for accelerating important capital projects as well. Lower costs of capital may mean that grid modernization and grid reliability investments should possibly go forward quickly once labor and supply chain issues are resolved.

Synchronizing the regulatory response to COVID-19

Utilities will suffer financial impacts because of the current crisis, and regulators will be asked to address these impacts. The key for regulators is to consider all of the impacts together, so that those that put upward pressure on rates and bills can be offset by those that provide downward pressure.

A first step would be to require utilities to create deferral or “suspense” accounts to track all the changes — positive and negative — in operating expenses, including labor, fuel and purchased power. The deferral of fuel adjustments until all other impacts can be considered would likely deny consumers some bill relief in the short run (when it will be most needed by consumers facing lost income) but may enable greater rate and bill stability in the next year or two by offsetting these against future sources of rate pressure.

A second is to require utilities to disclose any changes to their balance-of-year labor or capital construction expenses that can be identified. These may be upward or downward.

A third is to ensure that gained margins from additional residential sales are properly treated. In general, the sales margins are higher for residential sales than for large commercial and industrial sales. It is possible that a utility could experience a 10% decline in commercial and industrial sales, offset by a 5% increase in residential sales, generating the same company-wide sales margin.

A fourth is to ensure that the sharp impacts on consumption being experienced are not included in test periods for future rate cases unless they are determined by the regulator to be enduring changes. Expectations are that a vaccine will be developed within a year, and widely distributed within 18 months.

Finally, regulators should prepare to re-examine the utility cost of capital in conjunction with any application for rate relief due to lower sales volumes.

Special issues for decoupled jurisdictions

About half of US states have one or more electric utility operating under a revenue regulation (decoupling) framework, which provides some assurance that allowed revenue requirements will be recovered (absent prudence disallowances), independent of sales volumes. These were mostly designed to reduce utility incentives to pursue additional sales or to resist energy conservation and customer-sited renewable energy.

It is safe to say that none were designed with the current circumstance in mind: a sudden and deliberate pandemic-induced economic contraction such as we are experiencing. But it is equally certain that most are designed to provide recovery of lost sales margins from any cause (this has been a selling point, in comparison to lost revenue adjustment mechanisms), and utilities are currently experiencing lost sales margins.

A utility experiencing a 10% reduction in sales, and for which variable costs represent one-half of retail revenue, would expect about a 5% increase in rates through a decoupling mechanism. Then, in a year or two, when sales recover, the same utility would experience an increase in sales, and decrease in rates if the same mechanism were applied.

But the increase in rates from a decoupling adjustment will generally not be synchronized with the decrease in rates from lower fuel costs. This can lead to a situation where rates are reduced by 5% in the short-run, due to lower fuel costs, then increased a year later when fuel costs recover at exactly the same time that a decoupling adjustment also increases rates. By way of example, for Hawaii, with high fuel costs due to oil as the primary generating fuel, this could lead to a 10% or more decrease in rates as soon as May (from lower fuel costs), followed by a 20% increase in rates in a year’s time when a recovery in fuel costs may coincide with an upward decoupling adjustment to base rates.

Some decoupling mechanisms determine and apply adjustments within individual customer classes. Because residential sales are rising, while commercial and industrial sales are suspended, this can lead to a result where residential rates are reduced in a decoupling adjustment, while commercial rates must be increased. Regulators should probably require examination of changes in load shapes by customer class, to see if the cost of service of some classes may have declined, while for others it has increased. We caution, however, that reflecting this in larger rate increases for commercial customers may adversely affect general governmental efforts to retain and restore commercial activity and employment. [9]

A second option is to simply defer fuel cost and purchased power cost decreases in the short run to be offset against sales attrition-driven decoupling rate adjustments the following year.

Another option is to reconsider the allowed rate of return, given lower costs of debt and equity capital, in computing a decoupling adjustment. If the cost of capital has declined, this may be a reasonable way to offset the effect of lower sales volumes in a decoupling adjustment.

Special issues for performance-based regulatory programs

Many states have introduced performance-based regulation (PBR) elements to temper the utility incentive to increase earnings by increasing investment and instead link profits to desired outcomes. Some of these incentive mechanisms reward overall cost control, others reward specific resource acquisition, and still others reward progress towards specific regulatory goals. It is safe to say that none of these mechanisms anticipated the potential magnitude of impacts associated with the COVID-19 pandemic.

Most multi-year rate plans, a form of PBR, include some sort of “Z-factor” to account for deviations in consumption, revenues, or earnings that are outside of the PBR framework. The deviations due to COVID-19 may fall into this realm.

Some of the metrics for PBR will require re-examination considering current circumstances. For example, nearly every utility will achieve fuel cost reductions, even without any sort of special managerial skill. But some utilities will have adapted to a work-from-home regime for their office employees more adeptly than others, and thus been able to maintain system reliability and customer satisfaction better than others. This may be captured by existing service quality metrics, but it may be a new metric entirely.

Summary

Regulators will see filings from utilities seeking to recover from the financial impacts of the COVID-19 crisis. These filings may contain information on some, but not all, of the impacts. Regulators should take a solemn pause before they rush to adopt partial adjustments, ensuring that all relevant impacts, positive and negative, are considered concurrently. If interim rate relief is sought, regulators should consider all relevant impacts, with an eye to stability over the next 24-36 months.

———

[1] Strategen. (2020, April 15). Perfect 50-State Storm: COVID-19 and the Utility Crisis [Webinar]. Retrieved from https://www.strategen.com/webinar-perfectstorm

[2] Downey, J. (2020, April 6). Manufacturers Call on Duke Energy, Regulators to Suspend “Windfall” Charges During Pandemic. Charlotte Business Journal. Retrieved from https://www.bizjournals.com/charlotte/news/2020/04/06/manufacturers-call-on-duke-energy-regulators-to.html

[3] Sector and Sovereign Research (2020, April 20). Resilient Residential Sales and Robust Residential Gross Margins Should Protect Utility Profits Through the Lockdown.

[4] U.S. Energy Information Administration. Henry Hub Natural Gas Spot Price. Retrieved from https://www.eia.gov/dnav/ng/hist/rngwhhdD.htm

[5] ISO-New England. Pricing Reports — Monthly LMP Indices. Retrieved from https://www.iso-ne.com/isoexpress/web/reports/pricing/-/tree/monthly-lmp-indices

[6] Data from U.S. Department of the Treasury.

[7] US Bureau of Labor Statistics. Employment, Hours, and Earnings from the Current Employment Statistics Survey (National). Retrieved from https://data.bls.gov

[8] Cook, A.D. (2020, April 29). DTE to Cut Spending in Response to Pandemic. RTO Insider. Retrieved from https://rtoinsider.com/dte-cut-spending-response-pandemic-161582/

[9] For a discussion of the differentials in cost of service and cost of capital by class, see Chapter 7.2 of Electric Cost Allocation for a New Era: A Manual.