Like the all-powerful genies of mythology, artificial intelligence (AI) seems increasingly able to magically answer our questions and potentially grant wishes. Policymakers and regulators are still trying to understand the nuances of this technology and its impacts to energy systems. Some decision-makers charged with protecting the public interest see jobs, investment, and tax revenue. Others see soaring electric bills and potential blackouts. While this genie is flying around on magic carpets, regulators and policymakers are already rightly evaluating what their wishes should be.

Available information on the potential risks and benefits is incomplete and shifting. As evidenced, in late January 2025, Georgia Public Service Commission Vice Chairman Tim Echols articulated the thought on many utility regulators’ minds: “We want to keep Georgia the best place to do business, but data centers will need to bear the cost of their electricity acquisition.” In this blog, the first in a series on the topic of AI and data center demand, we’ll set the stage for what regulators need to know.

To begin, load growth is neither new nor specific to AI. The most recent 20 years or so of flat growth were preceded by decades of growing demand. And today, AI and data centers are only the latest arrival on the load growth spectrum; electrification has already increased demand and will continue to do so. Yet, the grid faces swelling timelines for interconnecting new generation driven by supply chain limitations and workforce shortages — all of which will drive price increases. Regardless of what is driving the load growth, policymakers and regulators face a new era wherein load growth presents challenges and opportunities to secure clean, affordable energy for all customers.

So why focus on AI and its unique challenges? Beyond enabling daily tasks like communicating or getting directions, AI has the potential to help utilities tackle the energy transition through more sophisticated forecasting or real-time operational support. And many of the largest data center developers can bring significant financial and technical resources that policymakers and regulators want to harness.

Below, you’ll find key aspects to the challenge.

Urgency

Data centers have exploded onto the national scene due to a sense of urgency to win the AI race at both a global and company scale. Both President Trump and former President Biden recognize the national security implications of establishing the U.S. as a global leader in the AI race. Individual companies are also racing each other. Former Microsoft executive Brian Janous coined the term “Watt-Bit Spread” to describe the “fundamental disconnect today between the cost of a watt and the value of the bits created by those watts.” The potential to box competitors out of the AI boom creates a huge incentive for first movers, meaning that the value of electricity to power data centers is worth significantly more in 2026 than in 2028. Thus, “time to power” is the biggest consideration for data center developers when selecting new sites. The traditional electric utility business model, meanwhile, prioritizes deliberate analysis and prudent actions to secure least-cost power. This spread — on both price tolerance and speed — is key to understanding the AI load dilemma.

Scale and Uncertainty

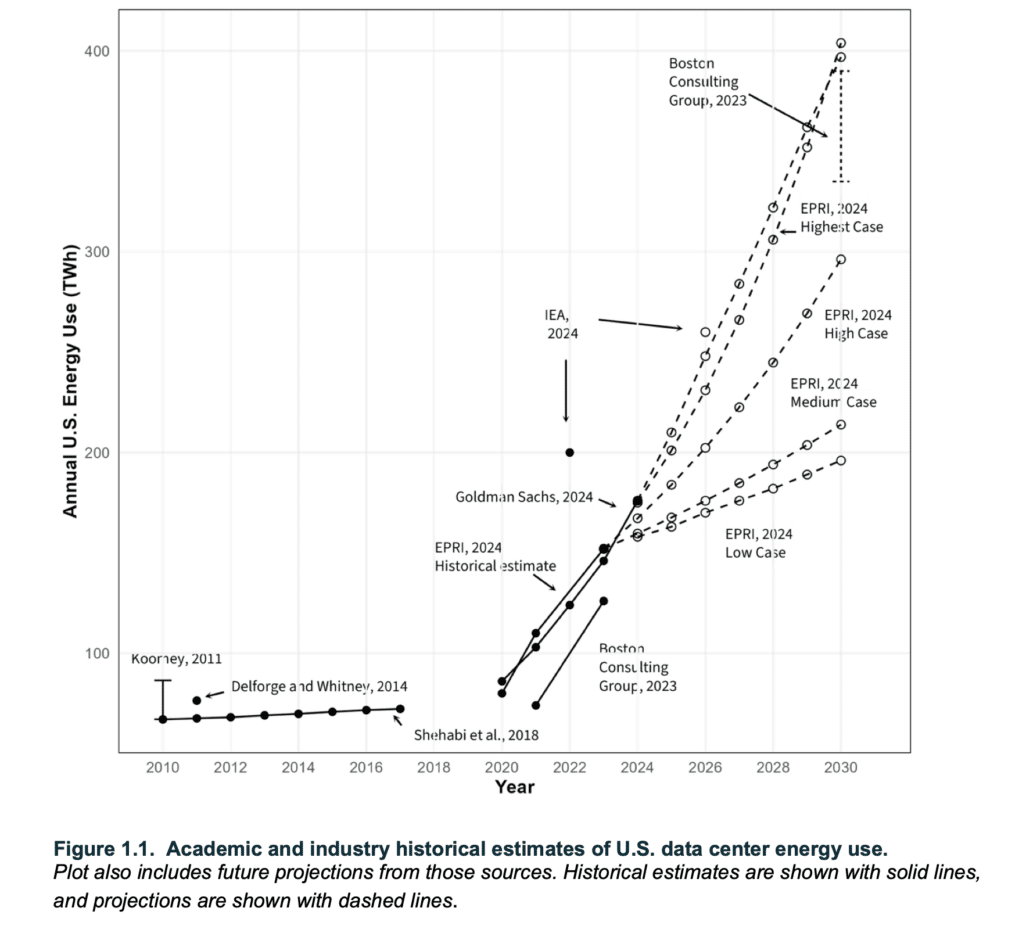

A user request for an artificial intelligence response, such as the one we used to locate this statistic, requires nearly 10 times the electricity of a traditional search. And the large loads required to provide these digital services are challenging the capability of the electric system to respond. While forecasts vary, as shown in figure below, the Department of Energy and Lawrence Berkeley National Laboratory estimate that, by 2028, data center annual power demand could consume up to 12% of total U.S. electricity consumption. Building enough infrastructure to serve AI load growth will be a challenge even at the lower end of these estimates.

High Density of Loads

Siting constraints and the growing size of individual facilities (e.g., Meta’s more than 2 GW Louisiana facility) also mean data center load is often highly concentrated, placing extreme pressure on local utilities and regulators. In Virginia, existing data centers already use the same amount of power (over 5 GW) as roughly 60% of households in the state; and 80% of that data center demand is concentrated in only three Northern Virginia counties. Yet because of their obligation to serve, Virginia utilities are unsure whether and how long they can delay interconnecting new loads, even if they lack the requisite generation capacity to maintain reliability.

Risks to Affordability and Reliability

Efforts to expand the grid quickly risk raising costs while decreasing resource adequacy, operating reliability, and resilience for all users. A Virginia report warned that “[a] typical residential customer of Dominion Energy could experience generation- and transmission-related costs increasing by an estimated $14 to $37 monthly in constant (or real) dollars by 2040 (independent of inflation).” These risks are particularly acute with uncertain load forecasts. Utilities and existing customers could be left holding the bag for huge infrastructure costs if the AI market does not develop at the rate predicted or energy efficiency breakthroughs significantly mitigate demand requirements (e.g., DeepSeek’s AI model may use 10 to 40 times less energy than similar U.S. technology).

Environmental Implications

Many Big Tech companies have made commitments to reduce the environmental impacts — particularly greenhouse gas emissions — from their data centers. But corporate commitments to obtain 24/7 carbon-free energy (e.g., by Google, Microsoft or Amazon) may go beyond existing resource mixes. And the urgency, scale, and concentration of AI load growth raises questions about what type of generation resources may be added. Beyond emissions, potential impacts include noise pollution and water usage.

RAP recognizes the pressure on regulators and policymakers to tackle these challenges strategically, without panic or overreaction. Existing regulatory approaches may need to be adapted or augmented, but regulators don’t have much time or expert staff to look at the technical challenges involved.

So, what does a balanced approach look like?

While subsequent blogs in this series will explore this question in more detail, a starting point is to gather information. The most relevant questions will depend on the type of balancing at issue: decisions made by policymakers at the wider state level (balancing power sector with other state-level goals) versus by utility regulators specifically (balancing among stakeholder interests). Both policymakers and regulators should start by scrutinizing load forecasts to determine whether and how much load will realistically materialize for each utility, what timelines are possible to meet that load, and what types of existing or additional generation and transmission would be required to meet demand. Policymakers and regulators should also examine what financial and technical resources data centers can bring to the table that could be harnessed, including load flexibility and on-site clean energy.

State-level policymakers should ask whether state agencies, particularly utility commissions, have the requisite regulatory tools to tackle these issues (e.g., integrated resource planning, flexibly interconnecting load), and if not, what action is needed. They should assess whether inter-agency processes (existing or new) would support regulators considering these applications and whether additional legislative guidance is needed. They should also conduct levelheaded estimates of jobs and other economic benefits along with collecting data on and analyzing potential environmental impacts.

Regulators, in turn, should begin by evaluating whether existing forecasting procedures will provide the robust scrutiny of AI load that’s required and whether other sources of load growth might ensure infrastructure investments remain durable regardless of AI forecasts. Regulators must also assess whether data center developers’ characteristics are distinct enough to merit special rate treatment or special contracts, whether and how existing rate structures could be adapted or augmented, and what types of commitments are appropriate before a utility begins accommodating their requests.

Ultimately, we suggest policymakers and regulators ground their load growth analysis in five key factors that can be the basis for robust and durable decision-making:

- Ensuring affordability

- Right-sizing infrastructure

- Mitigating environmental risk

- Protecting reliability/safety

- Enabling access

Subsequent blogs in this series will expand on these factors, offering recommended “do’s and don’ts” and deep-dive insights from our experts. Our goal is to empower regulators, policymakers, and industry leaders to proactively plan for this new load. This way they can develop strategies to protect existing ratepayers and harness available resources, including those provided by AI and Big Tech, to accelerate the transition to a more affordable, more reliable, safer, and cleaner electric grid.

Special thanks to Richard Sedano, Amy Carl, David Farnsworth, Mark LeBel, Alex Antal, Alison Silverstein and Damali Harding for their comments and insights.