Map for Elevating Decarbonization in Energy Regulation

Introduction

The Regulatory Energy Transition Accelerator (RETA, https://retatheaccelerator.

The two main products of the project are this webpage and the report. The report covers the rationale for the acceleration of the clean energy transition, highlights of the interviews with 25 regulators and five experts and offers an in-depth look at nine examples of creative prioritization of decarbonization in regulatory decision making. This webpage complements the report’s nine examples with two dozen more, providing a more global perspective of regulatory decarbonization implementation experiences.

Turks & Caicos

A proposed multisector public utility regulatory framework streamlines oversight of essential services in the Turks and Caicos Islands

Themes

Changes to the legal framework

Main Findings

Regulators need a decarbonization mandate

Recommendations

For Government: A decarbonization objective in legislation

For Government: More resources

Key Insights

Potential Enhancements to the legal/regulatory framework

| Where | Turks and Caicos Islands |

| Who | Energy and Utilities Department (EUD) |

| Link Organization | https://www.gov.tc/eud/ |

| Legal System | Common Law |

| Type of Solution | Policy Development and Implementation Technology Adoption and Integration Economic and Financial Mechanisms Public and Stakeholder Engagement |

Context — Problem/Issue

The energy sector in the Turks and Caicos Islands is highly dependent on fossil fuels, with very high energy costs and price volatility; renewables (solar) account for only 3% of installed capacity. Nonetheless, the sector is undergoing significant transformation, aiming for a sustainable and clean energy future, with the recent introduction of the Renewable Energy and Resource Planning Bill 2023, which targets a 33% share of energy from renewable sources by 2040, through the development of solar, wind and ocean energy technologies. The bill also encourages private sector investment through incentives and financial mechanisms and considers as key priorities environmental conservation and energy resilience, with efforts to mitigate environmental impacts and enhance the infrastructure’s resilience to natural disasters. The policy framework aims to streamline the permitting process for renewable energy projects and includes a competitive tendering process for project selection; it also introduces integrated resource plans and a net-billing program to allow excess electricity generated by buildings and businesses to be sold back to the grid.

Currently, the functions of the energy regulator, the Energy and Utilities Department (EUD), are comprised in the Electricity Ordinance and include inspection and testing of power plants, dispute resolution and any others assigned by the government. Under this mandate, the EUD is currently reviewing an application from FortisTCI (the main energy utility in the country) for a proposed 6% increase in electricity rates, set to take effect (if approved) on April 1, 2024. The last rate increase application was granted in 2020.

The new Renewable Energy and Resource Planning Bill will grant the EUD with specific mandates to implement the energy transition. The EUD will be in charge of overseeing the regulation and safe operation of renewable energy systems including the safe design and operation of renewable energy systems, ensuring that companies comply with licensing requirements, and establishing standards for timely connections to the grid. Furthermore, the EUD will oversee the Net-Billing Program and the implementation of the competitive tendering process, ensuring renewable energy projects are selected based on the most cost-effective bids, aiming to enhance energy affordability, reduce reliance on fossil fuels, and ensure a diverse and secure energy supply.

Among the efforts to reform and enhance the regulatory framework, a new policy is currently being discussed to implement a Multisector Public Utility Regulatory framework for critical services like telecommunications, electricity, water and sewerage, emphasizing innovation, environmental sustainability and high-quality service delivery. The proposed unified regulatory oversight will be under a newly established Commission, streamlining and enhancing efficiency and consumer focus. The EUD will lead the consultation phase

to refine the policy with input from service providers, consumer groups and industry experts.

Similar Examples

Azerbaijan's energy sector transformation and regulatory evolution (Azerbaijan)

URCA facilitating renewable integration (The Bahamas)

Self-generator pilot program to foster renewable energy (Grenada)

Responsibly sourced gas program limited by lack of decarbonization objective (Michigan)

BCUC's role in steering British Columbia towards a sustainable energy landscape (British Columbia)

Gas Infrastructure considered crucial to achieve decarbonization by 2050 (France)

ARERA balancing energy investments and sustainability with ROSS and TOTEX approach (Italy)

Charting the path to net-zero: CER's role in shaping Canada's energy transition (Canada)

Pilot program- optional premium payment to encourage renewable electricity supply (Michigan)

CNE's adaptative role in decarbonization efforts (Chile)

GNERC's strategic initiatives: implementing a sustainable energy landscape (Georgia)

Japan’s launch of long-term decarbonized power resource auctions (Japan)

New Mexico’s regulator ensuring a just transition through energy transition bonds (New Mexico)

EgyptERA’s strategic initiatives paving the way for renewable energy and efficiency

Responding to a broader regulatory mandate (United Kingdom)

Assessing ratepayer funding of a hybrid heating program (Canada, Québec)

Enabling regulatory change through regulatory sandboxes (Italy)

Getting government support for electricity tariffs that promote electrification (Ontario)

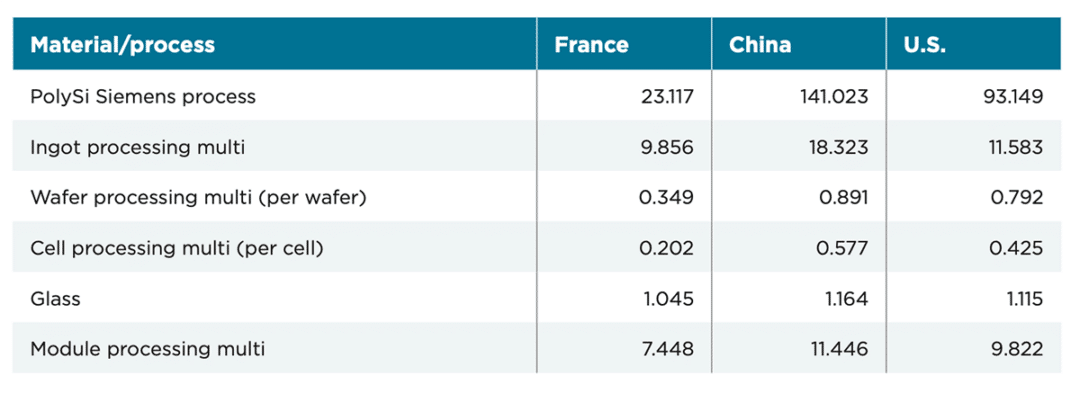

Addressing carbon content in solar PV procurement (France)

Interpreting new requirements to consider decarbonization in regulatory decision making (Australia)

EPRA's regulatory innovations fueling renewable adoption and EV infrastructure (Kenya)

Planning requirements — requiring utilities to model a decarbonized future (Michigan)

Argentina

Transforming Argentina's energy sector: a shift towards renewables and regulatory evolution (Argentina)

Argentina, despite being home to some of the world’s largest reserves of shale gas and oil, has been pivoting toward renewable energy, targeting a 20% renewable share in the power mix by 2025 and aiming for 30% by 2030. In 2022, renewables, particularly hydro and wind, made up almost 30% of power generation and 35% of installed capacity. This transition is further bolstered by Argentina’s abundant solar and wind resources and its position as a leading lithium producer, critical for the energy transition. Policy, legal and regulatory reforms are underway focusing on market opening, subsidy reduction and fostering renewable energy, marking a new era of energy policy post-December 2023’s governmental change.

Themes

Importance of government-regulator relationship in implementing sensitive decarbonization initiatives

Changes to the legal framework

Main Findings

An effective government-regulator relationship is vital

Regulators can help each other

Recommendations

For Government: Gather regulators’ inputs

For Regulators: Advise governments on practical implications

For Regulators: Reform regulatory processes

Key Insights

Government-regulator relationship

Application of decarbonization criteria in recent decisions

Appropriateness of existing legal/regulatory framework in addressing decarbonization

Potential Enhancements to the legal/regulatory framework

| Where | Argentina |

| Who | Argentinian Association of Regulatory Entities for Electricity (Asociación de Entes Reguladores Eléctricos) (ADERE) |

| Link Organization | https://adere.org.ar/web/ |

| Legal System | Civil Law |

| Type of Solution | Policy Development and Implementation Economic and Financial Mechanisms Public and Stakeholder Engagement |

Context — Problem/Issue

Argentina’s energy sector is primarily fueled by natural gas and oil, comprising 50% and 38% of the country’s total primary energy mix respectively in 2022. The nation is also recognized for its significant reserves of shale gas and shale oil, ranking as the world’s second and fourth largest respectively. Argentina aims to reach carbon neutrality by 2050 and has set an unconditional target of not exceeding 349 MtCO2e in 2030. Despite its fossil fuel resources, Argentina is making strides toward renewable energy, aiming for renewables to reach 20% of the power mix by 2025, according to the Renewable Energy Law of 2015, and 30% by 2030, according to Plan Nacional de Transición Energética a 2030 (National Energy Transition Plan 2030), a goal that’s spurred the deployment of utility-scale renewable projects. In 2022, renewables accounted for almost 30% of Argentina’s power generation mix (mainly hydro and wind) and 35% of installed capacity. Argentina’s focus on renewable energy is also motivated by its potential in solar and wind resources, alongside its status as the fourth largest lithium producer, crucial for battery storage systems and the energy transition. Additionally, the draft of the Hydrogen Promotion Law, currently under analysis, is expected to boost the decarbonization process and Argentina’s role as a global energy supplier. The government’s efforts are supported by initiatives like executing several auctions for renewable energy projects since 2016, which have added more than 6,300 MW of installed renewable energy capacity.

Argentina has multiple regulatory entities overseeing different aspects of its energy sector, including the national regulator for the electricity market (National Electricity Regulatory Entity — Ente Nacional Regulador de la Electricidad, ENRE) who oversees electricity generation and transmission, as well as various provinces that have their own regulatory bodies for local energy distribution and regulation. The Argentinian Association of Regulatory Entities for Electricity (ADERE), integrated by ENRE and most regulators of the country’s provinces, aims to exchange experiences, foster capacity building and training, promote international cooperation and exchanges focused on energy diversification and the expansion of renewable energy sources.

Previous legislation and political tendencies in Argentina resulted in limitations of fuel marketing, outdated compensation mechanisms for electric transportation expansions, high subsidies in the electricity sector, and certain special benefits for distributed renewable energy, which caused a stagnation of the energy sector and several limitations within the role of energy regulators. Furthermore, gas remains as the main energy driver, with high penetration within the sector and elevated subsidies that have dicentivized faster development of other technologies. All of this is expected to change considerably after the new government took power in December 2023, with a presidential decree that repeals several energy laws and regulations, with the goal to restructure the energy sector and thereby reduce subsidies, push distributed energy and renewables, and open the market to competition to foster private investment. Some regulatory changes are already taking place; in February 2024, the ENRE issued some guidelines for the analysis and implementations of smart meters and distribution tariff adjustments, requested the development of the power grid, and approved new renewable energy installed capacity. Several regulatory changes are yet to come and new regulators’ roles will be adapted to the new policy.

Similar Examples

Azerbaijan's energy sector transformation and regulatory evolution (Azerbaijan)

URCA facilitating renewable integration (The Bahamas)

Self-generator pilot program to foster renewable energy (Grenada)

Responsibly sourced gas program limited by lack of decarbonization objective (Michigan)

BCUC's role in steering British Columbia towards a sustainable energy landscape (British Columbia)

Gas Infrastructure considered crucial to achieve decarbonization by 2050 (France)

ARERA balancing energy investments and sustainability with ROSS and TOTEX approach (Italy)

Charting the path to net-zero: CER's role in shaping Canada's energy transition (Canada)

Pilot program- optional premium payment to encourage renewable electricity supply (Michigan)

CNE's adaptative role in decarbonization efforts (Chile)

GNERC's strategic initiatives: implementing a sustainable energy landscape (Georgia)

Japan’s launch of long-term decarbonized power resource auctions (Japan)

New Mexico’s regulator ensuring a just transition through energy transition bonds (New Mexico)

EgyptERA’s strategic initiatives paving the way for renewable energy and efficiency

Responding to a broader regulatory mandate (United Kingdom)

Assessing ratepayer funding of a hybrid heating program (Canada, Québec)

Enabling regulatory change through regulatory sandboxes (Italy)

Getting government support for electricity tariffs that promote electrification (Ontario)

Addressing carbon content in solar PV procurement (France)

Interpreting new requirements to consider decarbonization in regulatory decision making (Australia)

EPRA's regulatory innovations fueling renewable adoption and EV infrastructure (Kenya)

Planning requirements — requiring utilities to model a decarbonized future (Michigan)

Azerbaijan

Azerbaijan's energy sector transformation and regulatory evolution (Azerbaijan)

Azerbaijan, a prominent crude oil and natural gas producer and exporter, is navigating a significant shift toward a more sustainable and diversified energy portfolio under the guidance of the Ministry of Energy and the Azerbaijan Energy Regulatory Agency (AERA). Ambitious plans aim to escalate renewable energy’s share to 30% by 2030, supported by the Law on the Use of Renewable Energy Resources in Electricity Production and a strategic focus on reducing the carbon footprint. AERA’s efforts to promote efficiency, transparency and sustainable development include facilitating privatization in non-strategic areas, enhancing the electricity system’s efficiency, and preparing for the electric power sector’s deregulation and market liberalization by 2028. With recent legislation paving the way for a centralized electricity market and the unbundling of electricity services, AERA’s functions and international collaborations are set to expand, underpinning Azerbaijan’s role fostering energy security, sector efficiency and environmental sustainability.

Themes

Importance of government-regulator relationship in implementing sensitive decarbonization initiatives

Changes to the legal framework

Main Findings

An effective government-regulator relationship is vital

Regulators can help each other

Recommendations

For Government: Gather regulators’ inputs

For Regulators: Advise governments on practical implications

For Regulators: Reform regulatory processes

Key Insights

Government-regulator relationship

Application of decarbonization criteria in recent decisions

Appropriateness of existing legal/regulatory framework in addressing decarbonization

Potential Enhancements to the legal/regulatory framework

| Where | Azerbaijan |

| Who | Azerbaijan Energy Regulatory Agency (AERA) |

| Link Organization | https://regulator.gov.az/en/ |

| Legal System | Civil Law |

| Type of Solution | Policy Development and Implementation Technology Adoption and Integration Public and Stakeholder Engagement |

Context — Problem/Issue

Azerbaijan is a major crude oil and natural gas producer and exporter in the regional energy market. It’s energy sector, under the governance of the Ministry of Energy and the Azerbaijan Energy Regulatory Agency (AERA), is transitioning toward a more sustainable and diversified energy portfolio, emphasizing the development of renewable resources and energy efficiency. Despite its rich oil and gas heritage, the country has seen a significant increase in electricity generation (mostly by natural gas) which grew by over 50% since 2010. Renewable power generation capacity represented 16.5% in 2022 and 7% in electricity production (mainly hydro), with plans underway to further harness this potential through pilot projects and international cooperation and an aim to raise the share of renewable capacity to 30% by 2030. Nonetheless, the first solar panel was just installed in May 2023, in the country’s first major solar power plant. Azerbaijan aims to achieve a 40% reduction in emissions by 2050, compared to 1990 levels. The country is exploring its substantial renewable energy potential, including solar, wind, hydro, biomass and geothermal sources, supported by energy policy that emphasizes green energy and combating climate change. Recent legislative changes, such as the Law on the Use of Renewable Energy Resources in Electricity Production, follow this strategy to reduce the carbon footprint and ensure energy security while maintaining Azerbaijan’s role as a key energy player in the region.

AERA was established in 2017 to regulate and oversee the electricity, gas and heat supply sectors, aiming to ensure efficiency, transparency and sustainable development to ensure a diversified national production portfolio. AERA’s functions include tariff proposals, supervising market participants, participation in policy-making and implementation, certain licensing and permits, promotion of energy efficiency and conservation, offering regulatory incentives to encourage the uptake of energy-saving technologies and practices, maintaining energy supply reliability and safety, and fostering the integration of renewables into the grid, for which it has already issued several statutes.

One of AERA’s efforts to attract investment into the energy sector, aiming to diversify the national production and enhance the efficiency of the electricity system, includes the implementation of the initiative for the privatization of non-strategic production facilities, as outlined in national privatization programs. Five out of eight small hydropower plants open for privatization have successfully been transferred to private ownership and four of these privatized plants are currently being reconstructed and operated with private investments.

A major energy sector restructuring is currently being implemented in Azerbaijan, with the Law on Electric Power, published in May 2023, that aims to reform the electric power sector by gradually deregulating it and establishing a centralized electricity market, separating electricity generation, transmission, distribution and supply into independent entities to avoid monopolistic control over the sector. The law introduces a phased reform plan, with the separation of generation and the creation of a market operator by July 1, 2025, and the complete unbundling of distribution from transmission and supply, along with the full market deregulation by July 1, 2028. Initial measures to establish a regulatory framework and start the deregulation process will take effect on January 1, 2024.

AERA is in charge of developing the applicable regulatory framework to ensure a competitive liberal electricity market through the phased transition. AERA has been drafting and coordinating with relevant state bodies on projects for installation, safety and technical operation rules of electric devices, in addition to the approval of electricity network rules, among others.

In addition, AERA has been actively gathering regulatory international experience toward energy transition, network development and efficient investment planning. AERA’s international cooperation includes seminars, participation in regional training programs and bilateral cooperation meetings, covering potential regulatory frameworks for EV charging stations, R&D and innovation in energy distribution, reliability and stability of supply networks, tariff mechanisms for renewables and regulation mechanisms for electricity storage, among others. In February 2024, AERA signed a memorandum of understanding with the Georgian National Energy and Water Supply Regulatory Commission (GNERC), aiming to bolster cooperation in energy regulation and foster the development of bilateral relations through the exchange of regulatory experiences, sharing legislative developments, and organizing training on renewable energy and energy efficiency regulation. This collaboration builds on the existing partnership between AERA and GNERC within the Energy Regulators Regional Association (ERRA).

Similar Examples

Azerbaijan's energy sector transformation and regulatory evolution (Azerbaijan)

URCA facilitating renewable integration (The Bahamas)

Self-generator pilot program to foster renewable energy (Grenada)

Responsibly sourced gas program limited by lack of decarbonization objective (Michigan)

BCUC's role in steering British Columbia towards a sustainable energy landscape (British Columbia)

Gas Infrastructure considered crucial to achieve decarbonization by 2050 (France)

ARERA balancing energy investments and sustainability with ROSS and TOTEX approach (Italy)

Charting the path to net-zero: CER's role in shaping Canada's energy transition (Canada)

Pilot program- optional premium payment to encourage renewable electricity supply (Michigan)

CNE's adaptative role in decarbonization efforts (Chile)

GNERC's strategic initiatives: implementing a sustainable energy landscape (Georgia)

Japan’s launch of long-term decarbonized power resource auctions (Japan)

New Mexico’s regulator ensuring a just transition through energy transition bonds (New Mexico)

EgyptERA’s strategic initiatives paving the way for renewable energy and efficiency

Responding to a broader regulatory mandate (United Kingdom)

Assessing ratepayer funding of a hybrid heating program (Canada, Québec)

Enabling regulatory change through regulatory sandboxes (Italy)

Getting government support for electricity tariffs that promote electrification (Ontario)

Addressing carbon content in solar PV procurement (France)

Interpreting new requirements to consider decarbonization in regulatory decision making (Australia)

EPRA's regulatory innovations fueling renewable adoption and EV infrastructure (Kenya)

Planning requirements — requiring utilities to model a decarbonized future (Michigan)

Bahamas

URCA facilitating renewable integration (The Bahamas)

The Bahamas, a tourism-driven economy, faces unique energy challenges, primarily relying on imported oil for 99% of its energy needs. The nation aims to dramatically shift its energy landscape by 2030, targeting a 30% reduction in greenhouse gas emissions and ensuring at least 30% renewable energy in its mix. The Utilities Regulation and Competition Authority (URCA) is tasked with updating the regulatory framework to promote renewable energy integration, improve power quality and reliability, and foster stakeholder collaboration. Initiatives include frameworks for renewable energy system installation, quality standards, grid connectivity and the encouragement of private renewable energy generation.

Themes

How regulators are creatively addressing decarbonization

Acceleration of regulatory processes to advance decarbonization

Importance of government-regulator relationship in implementing sensitive decarbonization initiatives

Changes to the legal framework

Main Findings

Regulators are creatively addressing decarbonization

The regulatory handbrake on investment must be released

Regulators can help each other

Recommendations

For Government: A carbon price

For Government: Gather regulators’ inputs

For Government: More resources

For Regulators: Advise governments on practical implications

For Regulators: Anticipate the low-carbon future in their decisions

For Regulators: Reform regulatory processes

Key Insights

Application of decarbonization criteria in recent decisions

Potential Enhancements to the legal/regulatory framework

| Where | The Bahamas |

| Who | Utilities Regulation & Competition Authority (URCA) |

| Link Organization | https://www.urcabahamas.bs |

| Legal System | Common Law |

| Type of Solution | Policy Development and Implementation Technology Adoption and Integration Public and Stakeholder Engagement |

Context — Problem/Issue

The energy sector in the Bahamas is marked by its high dependency on imported oil, with 99% of energy needs met through oil products. By 2022, renewables only accounted for 1% of installed capacity (mainly solar). The Bahamas electricity system is distributed across 16 isolated island grids. The Bahamas plans to cut its greenhouse gas emissions by 30%, achieve a minimum of 30% renewable energy in its energy mix, and ensure that electric and hybrid vehicles constitute 35% and 15% of new vehicle acquisitions, respectively, all by 2030; and aims to achieve carbon neutrality by 2050. The country’s energy transition contemplates financial incentives for household solar, a transition to solar energy on less populated islands, and the retrofit of government buildings with renewable energy systems, supported by international funding.

The Utilities Regulation and Competition Authority (URCA) regulates both the energy and electronic communications sectors in The Bahamas, overseeing electricity generation, transmission and distribution. Guided by the 2015 Electricity Act and national energy policies advocating for dynamic governance fostering consultation, participation and public-private partnerships, URCA is in charge of promoting the effective integration of renewable energy into the energy mix, revising and updating the existing regulatory framework, and fomenting stakeholder and public collaboration. Initiatives include the establishment of a new framework to improve reporting requirements for power outages, the establishment of power quality and reliability standards, the integration of battery energy storage systems in the energy sector, revision of competition guidelines, along with the potential development of integrated plans to address cross-sectoral (electricity-communications) implications and dependencies, as outlined in URCA’s 2024 annual plan (issued for consultation in December 2023). This annual plan focuses on (i) identifying and addressing efficiency gaps in major electricity suppliers, (ii) the importance of supporting the diversification of the electricity generation mix and (iii) the strengthening of the transmission and distribution network to ensure a more resilient and sustainable energy future. URCA has also been analysing the implications of their somewhat vague mandate to oversee fuel charges, aiming to obtain further clarity on the elements and externalities that should be considered on the determination of such costs.

URCA has undertaken several initiatives to support the development of customer-owned renewable generation. It has issued regulatory frameworks for Small Scale Renewable Generation (SSRG) and Renewable Energy Self Generation (RESG) to encourage owners to meet their energy demands and export surplus energy to the grid. In its final decision, URCA focuses on the cost-effectiveness of various policy options for renewable energy self-generation projects. It includes detailed analysis and responses to stakeholder comments, sets out URCA’s stance on policy design options, compensation rates and the integration of renewable energy sources, and examines several policy scenarios, comparing their cost-effectiveness from the perspectives of the regulator, utility, participants and ratepayers. Key considerations include the impact of these policies on investment returns and utility rates, and the balance between incentivizing renewable energy investment and ensuring fair rates for ratepayers, with a particular focus on methods like Net-Billing and Buy-All/Sell-All arrangements and their implications for renewable energy adoption and cost recovery. These efforts have caused a significant uptick in renewable adoption, with a 22% increase in system installations and a 26% rise in capacity since 2021, mainly due to solar photovoltaic systems. In addition, to facilitate installation and use of private renewable energy systems by larger users such as large hotels, URCA has modified the licencing requirements to allow large users to operate self-generation.

Similar Examples

Azerbaijan's energy sector transformation and regulatory evolution (Azerbaijan)

URCA facilitating renewable integration (The Bahamas)

Self-generator pilot program to foster renewable energy (Grenada)

Responsibly sourced gas program limited by lack of decarbonization objective (Michigan)

BCUC's role in steering British Columbia towards a sustainable energy landscape (British Columbia)

Gas Infrastructure considered crucial to achieve decarbonization by 2050 (France)

ARERA balancing energy investments and sustainability with ROSS and TOTEX approach (Italy)

Charting the path to net-zero: CER's role in shaping Canada's energy transition (Canada)

Pilot program- optional premium payment to encourage renewable electricity supply (Michigan)

CNE's adaptative role in decarbonization efforts (Chile)

GNERC's strategic initiatives: implementing a sustainable energy landscape (Georgia)

Japan’s launch of long-term decarbonized power resource auctions (Japan)

New Mexico’s regulator ensuring a just transition through energy transition bonds (New Mexico)

EgyptERA’s strategic initiatives paving the way for renewable energy and efficiency

Responding to a broader regulatory mandate (United Kingdom)

Assessing ratepayer funding of a hybrid heating program (Canada, Québec)

Enabling regulatory change through regulatory sandboxes (Italy)

Getting government support for electricity tariffs that promote electrification (Ontario)

Addressing carbon content in solar PV procurement (France)

Interpreting new requirements to consider decarbonization in regulatory decision making (Australia)

EPRA's regulatory innovations fueling renewable adoption and EV infrastructure (Kenya)

Planning requirements — requiring utilities to model a decarbonized future (Michigan)

Michigan 4

Strategic approach to evaluate decarbonization criteria for the Low Carbon Energy Infrastructure Enhancement and Development (EIED) Grant (Michigan)

The Michigan Public Service Commission is tasked with managing a grant program aimed at fostering low-carbon energy infrastructure development to support initiatives such as natural gas, combined heat and power, renewable natural gas facilities, and electrification projects, with a significant focus on reducing carbon and other GHG emissions. The evaluation of potential projects involves a comprehensive assessment of emissions savings across different energy sources for an average customer, backed by detailed calculations and assumptions, alongside an analysis of the expected health impacts on communities from these low carbon energy facilities. Despite the absence of specific carbon pricing mechanisms, the regulator recommended the use of an existing model for life cycle emission reduction calculations.

Themes

How regulators are creatively addressing decarbonization

Main Findings

Regulators are creatively addressing decarbonization

Regulators need a decarbonization mandate

Recommendations

For Government: A carbon price

For Government: A decarbonization objective in legislation

For Regulators: Advise governments on practical implications

For Regulators: Anticipate the low-carbon future in their decisions

Key Insights

Potential Enhancements to the legal/regulatory framework

| Where | United States, Michigan |

| Who | Michigan Public Service Commission (MPSC) |

| Link Organization | https://www.michigan.gov/mpsc |

| Legal System | Common law |

| Type of Solution | Policy Development and Implementation Technology Adoption and Integration Economic and Financial Mechanisms |

Context — Problem/Issue

The Michigan Public Service Commission (MPSC) manages the Low Carbon Energy Infrastructure Enhancement and Development (EIED) Grant, a grant program aimed at fostering low-carbon energy infrastructure development. The assessment process for potential projects includes a detailed evaluation of emission reductions from various energy sources for the average customer, supported by precise calculations and assumptions, and considers the anticipated health benefits for communities from low-carbon energy facilities. Despite lacking specific carbon pricing frameworks, the regulator advises employing a recognized model for calculating life cycle emission reductions.

The MPSC is required by Public Acts 53 and 166 of 2022 to establish a grant program aimed at enhancing and developing low-carbon energy infrastructure, the Low Carbon Energy Infrastructure Enhancement and Development (EIED) Grant. This program is designed for businesses, nonprofit organizations and local government entities (unit of government or Tribal government) to support activities such as planning, developing, designing, acquiring or constructing facilities for low-carbon energy. The legislative grant term for this program is set to conclude on September 30, 2027. The types of projects that could be funded include, but are not limited to, natural gas facilities, combined heat and power facilities, renewable natural gas facilities and electrification initiatives.

The MPSC is in charge of evaluating and issuing an award recommendation of the potential projects to receive the grant. For this, in September 2022, the MPSC published a Request for Proposals (RFP) on its website. Subsequently, the received proposals were made publicly available on the grant’s webpage, with a final submission deadline by March 14, 2023. This setup facilitated a 45-day period for public comment, followed by an additional 15 days allocated for applicants to make any necessary adjustments to their proposals.

One of the purposes of the grants is to support the reduction of carbon emissions and any other greenhouse gas (GHG) emissions reductions resulting from the project. Among the criteria to be evaluated, the MPSC had to consider:

- A comprehensive analysis of different scopes of emissions, as categorized by the Environmental Protection Agency, comparing the emissions associated with the proposed energy supply against those from the current energy sources used by prospective customers and other available alternative energy options. This comparison encompasses:

a. The estimated emissions savings for an average customer across various energy supply alternatives.

b. Supporting information for the emissions calculations, detailing the models used and the assumptions made in these calculations. - An analysis of the anticipated community health impacts related to the proposed low-carbon energy facility.

Despite not having clear carbon pricing mechanisms to evaluate emissions savings and health impacts, the MPSC included in the cost benefit test analysis requirements (described in Attachment 3 of the RFP) a recommendation for the calculation of carbon emissions reductions, by employing a life cycle analysis using the Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies (GREET) model, which was created by the Argonne National Laboratory.

Following a thorough evaluation, the MPSC approved $50M in low-carbon energy infrastructure grants for 15 projects, including grid-scale energy storage, community solar, electric vehicle infrastructure, renewable natural gas and expansion of natural gas to areas now reliant on propane (Case No. U-21293).

Who first approached the problem?

Legislation mandates the regulator to develop program guidelines and implement an application process for the grant and must first prioritize and approve grants that do all of the following: (a) are supported by a cost-benefit analysis; (b) facilitate the largest number of end-use customers achieving access to low-carbon energy facilities at the lowest total cost; (c) reduce customer energy cost burdens; and (d) support the reduction of emissions.

Potential Solution

The regulator designed and issued the request for proposals to evaluate potential projects for the award of the grant, including a recommendation to evaluate decarbonization criteria, despite not having clear carbon pricing mechanisms.

Economic and Financial Mechanisms:

Despite the absence of specific carbon pricing mechanisms, the regulator recommended the use of an existing model for life cycle emission reduction calculations for the evaluation of projects for the Low Carbon Energy Infrastructure Enhancement and Development (EIED) Grant.

Similar Examples

Azerbaijan's energy sector transformation and regulatory evolution (Azerbaijan)

URCA facilitating renewable integration (The Bahamas)

Self-generator pilot program to foster renewable energy (Grenada)

Responsibly sourced gas program limited by lack of decarbonization objective (Michigan)

BCUC's role in steering British Columbia towards a sustainable energy landscape (British Columbia)

Gas Infrastructure considered crucial to achieve decarbonization by 2050 (France)

ARERA balancing energy investments and sustainability with ROSS and TOTEX approach (Italy)

Charting the path to net-zero: CER's role in shaping Canada's energy transition (Canada)

Pilot program- optional premium payment to encourage renewable electricity supply (Michigan)

CNE's adaptative role in decarbonization efforts (Chile)

GNERC's strategic initiatives: implementing a sustainable energy landscape (Georgia)

Japan’s launch of long-term decarbonized power resource auctions (Japan)

New Mexico’s regulator ensuring a just transition through energy transition bonds (New Mexico)

EgyptERA’s strategic initiatives paving the way for renewable energy and efficiency

Responding to a broader regulatory mandate (United Kingdom)

Assessing ratepayer funding of a hybrid heating program (Canada, Québec)

Enabling regulatory change through regulatory sandboxes (Italy)

Getting government support for electricity tariffs that promote electrification (Ontario)

Addressing carbon content in solar PV procurement (France)

Interpreting new requirements to consider decarbonization in regulatory decision making (Australia)

EPRA's regulatory innovations fueling renewable adoption and EV infrastructure (Kenya)

Planning requirements — requiring utilities to model a decarbonized future (Michigan)

Grenada 2

Self-generator pilot program to foster renewable energy (Grenada)

The Grenada’s Public Utilities Regulatory Commission (PURC) launched a Self-Generator Program designed to foster renewable energy adoption by allowing individuals to generate their own electricity for personal use and sell excess power back to the grid. Initially granting a 15-year renewable permit, this program supports the shift from net-billing to net-metering, which benefits consumers by allowing them to utilize their green energy first before selling any surplus. It aims to install up to 1 Megawatt of renewable capacity, with specific generation limits based on residential and non-residential status. The process involves a clear application procedure, highlighting the benefits of decreased electricity bills, increased self-reliance and contribution to reducing Grenada’s carbon footprint.

Themes

How regulators are creatively addressing decarbonization

Main Findings

Regulators are creatively addressing decarbonization

Recommendations

For Government: More resources

For Regulators: Anticipate the low-carbon future in their decisions

Key Insights

Application of decarbonization criteria in recent decisions

| Where | Grenada |

| Who | Public Utilities Regulatory Commission (PURC) |

| Link Organization | https://purc.gd |

| Legal System | Common Law |

| Type of Solution | Economic and Financial Mechanisms Public and Stakeholder Engagement |

Context — Problem/Issue

Climate risks in Grenada, like many small island states, are particularly acute due to its geographic and economic vulnerabilities. These risks include sea-level rise, increased intensity of tropical storms and changes in precipitation patterns. Climate change poses a significant threat to Grenada’s critical sectors, including tourism and marine-based industries, impacting the entire spectrum of the nation’s economic activities.

With an electricity sector historically reliant on imported diesel fuel, the shift towards renewable sources like solar and wind is not only a decarbonization effort but also a strategy to enhance energy security and reduce price volatility. The government of Grenada has pledged to cut its greenhouse gas emissions by 30% by 2025 from its 2010 levels, with a goal of achieving 10% (approximately 27MW) of this reduction by incorporating renewable energy into the power generation mix. Nonetheless, by 2023, renewable energy in Grenada only accounted for 5% of net generation (2.8 MW), despite having good renewable energy source potential.

The Public Utilities Regulatory Commission (PURC), serving as the electricity sector’s independent regulatory body, is tasked with promoting and ensuring the sustainable adoption and use of renewable energy sources and aims to reduce the country’s reliance on fossil fuels. It was established by the PURC Act No. 20 of 2016 and launched in July 2019. It sets and reviews tariffs for public utilities, handles consumer complaints, and oversees the procurement for generation, transmission and distribution systems, with a focus on facilitating renewable energy. Additionally, the PURC makes recommendations to the Minister on licensing for renewable energy production, emphasizing the government’s intention to significantly adopt renewable energy.

The Electricity Supply Act of 2016, (Amendment in 2017), aims to ensure a regular, efficient, coordinated and economical supply of electricity in Grenada. It establishes a framework to accelerate the development of electricity from renewable energy sources, detailing the roles and responsibilities of the Minister and the PURC in regulating the sector. It covers the promotion of renewable energy, the integration of independent power producers and self-generators, and the competitive procurement of generation capacity. It emphasizes sustainable and efficient electricity generation and use, aiming to reduce reliance on imported fossil fuels and lower electricity costs. Additionally, the Electricity Act covers licensing requirements and specifically states (Section 14) that the issuance of licenses shall be prioritized to entities that generate electricity from renewable energy sources or to those whose electricity production significantly lowers consumer costs, reduces Grenada’s carbon footprint and lessens its reliance on imported fossil fuels.

Self Generator Pilot Program

The Electricity Supply Act (Sections 4(h), 13.3 & 25) mandates the PURC to regulate self-generation in Grenada and to determine the criteria for participation. It also establishes guidelines for self-generators to operate their systems and connect to the grid, enabling them to sell any surplus electricity to the Network Licensee (GRENLEC, the vertically integrated electricity monopoly, publicly traded on the Eastern Caribbean Securities Exchange, regulated by the PURC).

In 2021, the PURC launched a 12 month Self Generator Pilot Program (still in force), an initiative that permits individuals and businesses to produce their own electricity using renewable sources, mainly for self-use, while also allowing them to sell any surplus energy back to the grid. Permits are initially issued for a 15-year period, with the option for renewal. The program aims to achieve the installation of up to 1 MW of electrical capacity sourced from renewable energies, mainly solar photovoltaic. It contemplates a transition from net-billing, where customers sold all generated electricity at a low price, to net-metering, allowing customers to use their generated “green energy” first and sell any excess.

To benefit from the program, applicants need, among other technical requirements, a two-register meter configuration. GRENLEC is in charge of the installation and maintenance of the meters. Additionally, an interconnection agreement will be required between GRENLEC and the self-generator, who will be in charge of the maintenance of the generating facility.

Self-generators are granted non-discriminatory access to the grid managed by GRENLEC. It retains, however, the right to disconnect a customer’s generation unit from the electricity network due to safety concerns, contract violations or debts to GRENLEC.

This program contemplates generation limits per type of permit holders:

- Residential: can generate 1.2 times their current average annual kWh consumption

- Non-Residential: limited to generating 0.6 times their current average annual kWh consumption

The intended benefits of the program include decreased electricity bills, payment for surplus energy sold to the grid, increased self-reliance with storage and contribution to reducing Grenada’s carbon footprint.

Similar Examples

Azerbaijan's energy sector transformation and regulatory evolution (Azerbaijan)

URCA facilitating renewable integration (The Bahamas)

Self-generator pilot program to foster renewable energy (Grenada)

Responsibly sourced gas program limited by lack of decarbonization objective (Michigan)

BCUC's role in steering British Columbia towards a sustainable energy landscape (British Columbia)

Gas Infrastructure considered crucial to achieve decarbonization by 2050 (France)

ARERA balancing energy investments and sustainability with ROSS and TOTEX approach (Italy)

Charting the path to net-zero: CER's role in shaping Canada's energy transition (Canada)

Pilot program- optional premium payment to encourage renewable electricity supply (Michigan)

CNE's adaptative role in decarbonization efforts (Chile)

GNERC's strategic initiatives: implementing a sustainable energy landscape (Georgia)

Japan’s launch of long-term decarbonized power resource auctions (Japan)

New Mexico’s regulator ensuring a just transition through energy transition bonds (New Mexico)

EgyptERA’s strategic initiatives paving the way for renewable energy and efficiency

Responding to a broader regulatory mandate (United Kingdom)

Assessing ratepayer funding of a hybrid heating program (Canada, Québec)

Enabling regulatory change through regulatory sandboxes (Italy)

Getting government support for electricity tariffs that promote electrification (Ontario)

Addressing carbon content in solar PV procurement (France)

Interpreting new requirements to consider decarbonization in regulatory decision making (Australia)

EPRA's regulatory innovations fueling renewable adoption and EV infrastructure (Kenya)

Planning requirements — requiring utilities to model a decarbonized future (Michigan)

Michigan 3

Responsibly sourced gas program limited by lack of decarbonization objective (Michigan)

The lack of an explicit decarbonization objective or carbon price meant it was not possible for the Michigan regulator, Michigan Public Service Commission (MPSC), to support to support incurring extra expenses for potential environmental advantages for responsibly sourced gas program.

Themes

How regulators are creatively addressing decarbonization

Changes to the legal framework

Main Findings

Regulators need a decarbonization mandate

Recommendations

For Government: A carbon price

For Government: A decarbonization objective in legislation

For Regulators: Anticipate the low-carbon future in their decisions

Key Insights

Appropriateness of existing legal/regulatory framework in addressing decarbonization

| Where | United States, Michigan |

| Who | Michigan Public Service Commission (MPSC) |

| Link Organization | https://www.michigan.gov/mpsc |

| Legal System | Common law |

| Type of Solution | Economic and Financial Mechanisms |

Context — Problem/Issue

The legislation (Public Act 304 of 1982) does not justify additional costs attributed to potential environmental benefits; hence the regulator, Michigan Public Service Commission (MPSC) is hindered to approve the request to recover premium costs for responsibly sourced gas, without clear justification of users’ benefits.

Case U-21064

In December 2021, pursuant to Public Act 304 of 1982, a gas utility, DTE Gas Company, requested the MPSC for approval of a gas cost recovery plan and authorization of gas cost recovery factors for the 12-month period April 2022-March 2023, which was later amended in May 2022 with revised supporting testimony and exhibits.

The company claimed that it was involved in industry groups and collaboratives to focus on the reduction of methane emissions and included in its gas cost recovery plan premiums above the base cost of gas purchases for responsibly sourced gas (RSG) as part of its net-zero commitment on gas supply strategy, as well as additional costs of certification and auditing that would be required for it to purchase such RSG. DTE Gas Company aimed to recover an underlying commodity cost and the cost of a third-party certification, a premium of $36,808 on a gas cost of $7.8 million for RSG.

On July 2023, an Administrative Law Judge issued a Proposal for Decision by which it contested the company’s purchase of responsibly sourced gas at a premium above the base cost of gas, among other things. It included a warning to DTE Gas indicating that the $36,808 premium paid for RSG may not be recoverable in future cost reconciliation cases, stating that the company had not made a compelling and convincing case that purchasing RSG was in the best interest of customers or that it would make a significant difference in reducing greenhouse gas emissions. The basis for this position is rooted in the interpretation of Act 304, since it does not consider environmental attributes when evaluating whether costs are reasonable and prudent regarding gas supply choices. Consequently, Act 304 does not justify additional costs attributed to potential environmental benefits in evaluating the reasonableness and prudence of such expenditures. Furthermore, since the RSG requires a premium for certification yet does not offer increased reliability over non-RSG certified gas, it should not be considered a reasonable or prudent supply option under the current language of Act 304. Act 304 also mandates utilities to undertake all necessary legal and regulatory measures to reduce the cost of purchased gas. Given that RSG performs identically to gas acquired without the ‘responsibly sourced’ label, it fails to satisfy the criteria for being deemed reasonable and prudent.

In August 2023, DTE Gas Company requested the MPSC to reject the judge’s recommendation for a warning regarding the rejection of approval of the premium amount of $36,808 paid for responsibly sourced gas (RSG).

Finally, in October 2023, the MPSC ordered the issuance of a warning to DTE Gas Company that the premium of $36,808 paid for responsibly sourced gas may not be recoverable in future reconciliation cases without first providing evidence of how responsibly sourced gas delivers a benefit to customers. For this decision, the MPSC considered that it was not clear, from the testimonies received during hearings, how RSG would lower the composition of methane in the gas.

Who first approached the problem?

A gas utility applied to recover premium costs for responsibly sourced gas, claiming the reduction of methane emissions but failed to prove the final benefits to consumers. The regulator did not have any decarbonization authority to factor in any environmental considerations, but in its decision, it set out the path on how future utilities could better frame their arguments, following a previous case (Case No. U-20940).

Potential Solution

The MPSC acknowledged the potential benefits of RSG but concurred with the Administrative Law Judge and the Attorney General, that a Section 7 warning regarding the RSG premium payment was necessary. It stated that its decision was not an outright dismissal of RSG’s value but reflects the current lack of record support for its procurement, leaving room for DTE Gas Company to seek expense recovery in future rate cases or provide further justification during cost reconciliation. The MPSC’s stance is not a blanket statement against RSG procurement’s prudence. Instead, DTE Gas may still pursue expense recovery in future filings, provided it can present more substantial evidence of RSG’s benefits to customers, akin to the Commission’s expectations in a previous order (Case No. U-20940) concerning the recovery of research and development costs aimed at reducing carbon intensity. In that case, the Commission expected DTE Gas to demonstrate a clear link between costs and benefits to customers, a standard that applies to RSG premium recovery efforts. The absence of sufficient evidence in the current case regarding how RSG benefits DTE Gas’s customers, such as potential cost savings from reduced supply chain emissions, does not preclude the possibility of such benefits being recognized and supported in future submissions.

Policy Development and Implementation

Positive changes toward the implementation of decarbonization in the regulator’s decision-making are coming into force. In 2022 Michigan issued the MI Healthy Climate Plan that recommends to enhance the MPSC approach to include an environmental justice and health impact analysis within the Integrated Resource Planning (IRP) process, ensuring a comprehensive evaluation of community impacts stemming from utility investment choices. The 2023 Clean Energy Legislation marks a significant shift, granting the MPSC the unprecedented ability to factor in climate, affordability and environmental justice considerations into utility integrated resource plans. It also requires the MPSC to perform an environmental justice analysis for the location of any new or upgraded natural gas facilities. Similarly, it requires the utilities to conduct analogous assessments for the retirement of fossil fuel peaker plants, ensuring that community impacts are considered alongside economic factors.

To meet the goals of the MI Healthy Climate Plan, a package of bills was passed in 2023 that, among others, centers environmental justice and equity in clean energy programs. The MPSC now has the authority to incorporate considerations of climate, environmental justice (EJ) and non-discrimination into their evaluations of long-term utility plans. This expansion broadens their capabilities to ensure that the implementation of clean energy laws is done equitably. The recent legislation enhances public involvement, particularly emphasizing the participation of residential ratepayers, EJ communities and those experiencing significant energy burdens in the decision-making process. The laws further mandate the MPSC to perform environmental justice reviews for all new or improved natural gas facilities and for the decommissioning of fossil fuel plants. These laws also extend the responsibilities of the Department of Environment, Great Lakes, and Energy (EGLE) to offer advisory opinions on long-term utility plans, now requiring assessments of the plans’ potential environmental impacts, their alignment with the state’s climate objectives, and their effects on environmental justice and public health.

Economic and Financial Mechanisms:

The regulator issued a warning that a premium the company paid for third-party certified responsibly sourced gas may not be recoverable in future reconciliation cases without clearly demonstrating benefits to customers, as previously suggested in another case.

Similar Examples

Azerbaijan's energy sector transformation and regulatory evolution (Azerbaijan)

URCA facilitating renewable integration (The Bahamas)

Self-generator pilot program to foster renewable energy (Grenada)

Responsibly sourced gas program limited by lack of decarbonization objective (Michigan)

BCUC's role in steering British Columbia towards a sustainable energy landscape (British Columbia)

Gas Infrastructure considered crucial to achieve decarbonization by 2050 (France)

ARERA balancing energy investments and sustainability with ROSS and TOTEX approach (Italy)

Charting the path to net-zero: CER's role in shaping Canada's energy transition (Canada)

Pilot program- optional premium payment to encourage renewable electricity supply (Michigan)

CNE's adaptative role in decarbonization efforts (Chile)

GNERC's strategic initiatives: implementing a sustainable energy landscape (Georgia)

Japan’s launch of long-term decarbonized power resource auctions (Japan)

New Mexico’s regulator ensuring a just transition through energy transition bonds (New Mexico)

EgyptERA’s strategic initiatives paving the way for renewable energy and efficiency

Responding to a broader regulatory mandate (United Kingdom)

Assessing ratepayer funding of a hybrid heating program (Canada, Québec)

Enabling regulatory change through regulatory sandboxes (Italy)

Getting government support for electricity tariffs that promote electrification (Ontario)

Addressing carbon content in solar PV procurement (France)

Interpreting new requirements to consider decarbonization in regulatory decision making (Australia)

EPRA's regulatory innovations fueling renewable adoption and EV infrastructure (Kenya)

Planning requirements — requiring utilities to model a decarbonized future (Michigan)

British Columbia

BCUC's role in steering British Columbia towards a sustainable energy landscape (British Columbia)

The British Columbia Utilities Commission (BCUC) of British Columbia, Canada has taken significant strides toward fostering clean energy within the province, mandating collaborative strategic planning among major energy utilities. In a notable initiative from 2022, BCUC launched a process to explore the long-term implications of evolving energy scenarios on BC’s electric and gas sectors to align with greenhouse gas reduction targets, especially in emerging sectors like hydrogen and carbon capture. BCUC has also addressed the marketing of biomethane by proposing a shift to new pricing strategies to stimulate renewable natural gas demand and ensure financial viability. BCUC’s commitment to environmental objectives, however, has also led to scrutiny over proposals lacking clear low-carbon transition plans, as seen in the rejection of an expansion request for a district heating system which lacked just such a clear plan for transitioning to a low-carbon alternative.

Themes

How regulators are creatively addressing decarbonization

Main Findings

Regulators are creatively addressing decarbonization

The regulatory handbrake on investment must be released

Recommendations

For Government: A decarbonization objective in legislation

For Regulators: Anticipate the low-carbon future in their decisions

For Regulators: Reform regulatory processes

Key Insights

Application of decarbonization criteria in recent decisions

| Where | Canada, British Columbia |

| Who | British Columbia Utilities Commission (BCUC) |

| Link Organization | https://www.bcuc.com |

| Legal System | Common Law |

| Type of Solution | Technology Adoption and Integration Economic and Financial Mechanisms Public and Stakeholder Engagement |

Context — Problem/Issue

British Columbia’s energy sector relies significantly on renewable sources, with hydroelectric power leading in electricity generation. It has set goals to reduce its greenhouse gas emissions from 2007 levels by 16% by 2025, 40% by 2030, 60% by 2040, and 80% by 2050, for which the province is exploring emerging renewables like wind, solar, biomass and geothermal energy. Furthermore, British Columbia is presently engaged in consultations for a “climate-aligned energy framework,” expected to serve as the initial step toward developing a comprehensive energy strategy. Additionally, British Columbia’s significant natural gas reserves, especially in the Northeast, play a crucial role in meeting local demand and positioning the province as a potential leader in the liquified natural gas export market, taking advantage of its strategic Pacific coast location to target Asian markets.

The British Columbia Utilities Commission (BCUC) serves as the independent regulator for the province’s energy sector covering utilities, common carrier pipeline operations and rates, and the reliability of the electricity transmission grid; it is tasked with ensuring safe, reliable and equitable energy services at reasonable rates.

BCUC Pushing for joint strategic planning from energy utilities

BCUC has been proactively taking initiatives toward clean energy. In 2022, BCUC issued a process to explore energy scenarios and the resulting interdependent long-term implications on the province’s primary electric and gas utilities. It requested that BC Hydro (a public monopoly electric utility) and FortisBC Energy Inc. (FEI) (the largest distributor of natural gas) exchange and submit data for load forecast results based on each other’s scenarios from their resource plans, along with detailed commentary on the potential effects on supply resources, rate changes and greenhouse gas emissions associated with each scenario, with a goal to develop a consistent planning approach across fuels. Part of the information provided to BCUC included a summary of assumptions regarding hydrogen supply volumes; both utilities’ scenarios confirm an anticipated increase in electricity demand from hydrogen production, the assumptions for modelling the increased electricity demand are due to customers transitioning from gas to electricity. This resulted in the recent BCUC’s approval in March 2024 of BC Hydro’s updated integrated resource plan, for the next 20 years, that addresses increasing electricity demand through energy efficiency programs and energy purchases from independent producers, prioritizing greenhouse gas emissions reduction, maintaining low electricity rates, minimizing environmental impacts, supporting Indigenous reconciliation and boosting the economy. For this, BCUC agreed that BC Hydro would need to acquire about 3,000 GWh of clean electricity from new facilities by 2029 and an additional 700 GWh from existing facilities before 2029, increasing its energy resources by over 5%. The decision regarding FEI’s long term gas resource plan approval is still pending.

Fostering renewable natural gas with premium incentives for cost recovery

FEI requested the BCUC to be able to market biomethane as a premium gas product, given that it is more expensive than conventional natural gas. FEI charges a biomethane rate, intended to fully recover its supply and program costs, to those customers who purchase it on a voluntary basis. FEI suggested switching from the cost-based Biomethane Energy Recovery Charge (BERC) rate to two new rates: a Short-Term and a Long-Term BERC Rates, intended to increase renewable natural gas (RNG) demand, raise revenues and lessen the financial burden on non-bypass ratepayers. FEI’s strategy was to sell most or all of the available RNG supply at a lower price, rather than selling a smaller volume at a higher price. The BCUC approved in 2016 the short term rate for biomethane based on a premium above conventional gas cost, along with the long term rate that comprised a discount to the short term one to reflect potential benefits to FEI (including long-term revenue certainty, predictable load and reduced marketing efforts). By 2021, FEI reported that the BERC rate successfully led to higher sales volumes and increased revenues but, after concerns over the risk of a significant discrepancy arising between the short-term and long-term rates established in long-term contracts threatening the chance to maximize revenues, the BCUC instructed FEI to update the long-term rates as needed.

BCUC’s Scrutiny of District Heating Proposals Amid Carbon Reduction Goals

In 2015, the BCUC reviewed a proposal by Creative Energy (a private district heating company) for the expansion of a district heating system to Northeast False Creek and Chinatown in Vancouver. The issue was that district heating system relied on natural gas as the heating fuel, meaning that the project would not lead to meaningful greenhouse gas emissions reductions. The BCUC turned down the Chinatown extension due to continued reliance of the district heating system on fossil fuels and the absence of a definitive plan for transitioning to a low-carbon alternative.

Similar Examples

Azerbaijan's energy sector transformation and regulatory evolution (Azerbaijan)

URCA facilitating renewable integration (The Bahamas)

Self-generator pilot program to foster renewable energy (Grenada)

Responsibly sourced gas program limited by lack of decarbonization objective (Michigan)

BCUC's role in steering British Columbia towards a sustainable energy landscape (British Columbia)

Gas Infrastructure considered crucial to achieve decarbonization by 2050 (France)

ARERA balancing energy investments and sustainability with ROSS and TOTEX approach (Italy)

Charting the path to net-zero: CER's role in shaping Canada's energy transition (Canada)

Pilot program- optional premium payment to encourage renewable electricity supply (Michigan)

CNE's adaptative role in decarbonization efforts (Chile)

GNERC's strategic initiatives: implementing a sustainable energy landscape (Georgia)

Japan’s launch of long-term decarbonized power resource auctions (Japan)

New Mexico’s regulator ensuring a just transition through energy transition bonds (New Mexico)

EgyptERA’s strategic initiatives paving the way for renewable energy and efficiency

Responding to a broader regulatory mandate (United Kingdom)

Assessing ratepayer funding of a hybrid heating program (Canada, Québec)

Enabling regulatory change through regulatory sandboxes (Italy)

Getting government support for electricity tariffs that promote electrification (Ontario)

Addressing carbon content in solar PV procurement (France)

Interpreting new requirements to consider decarbonization in regulatory decision making (Australia)

EPRA's regulatory innovations fueling renewable adoption and EV infrastructure (Kenya)

Planning requirements — requiring utilities to model a decarbonized future (Michigan)

France 4

Gas Infrastructure considered crucial to achieve decarbonization by 2050 (France)

The French Energy Regulator (Commission de Régulation de l’Énergie, CRE) is pivotal in transitioning France toward a sustainable gas infrastructure, as the country is aiming for carbon neutrality by 2050. It enforces the Energy Code to support biogas injection, manages the adaptation of networks for renewable gas and explores future scenarios for gas infrastructure, concluding that most of the existing gas infrastructure will be needed until 2050. With its approval of 21 zoning projects in February 2024, the CRE establishes a framework for integrating renewable gases, ensuring the network’s evolution aligns with France’s energy sovereignty and climate goals.

Themes

How regulators are creatively addressing decarbonization

Main Findings

Regulators are creatively addressing decarbonization

An effective government-regulator relationship is vital

Recommendations

For Government: Gather regulators’ inputs

For Government: More resources

For Regulators: Advise governments on practical implications

For Regulators: Reform regulatory processes

Key Insights

Application of decarbonization criteria in recent decisions

Appropriateness of existing legal/regulatory framework in addressing decarbonization

Potential Enhancements to the legal/regulatory framework

| Where | France |

| Who | Energy Regulatory Commission (Commission de Régulation de l’Énergie, CRE) |

| Link Organization | https://www.cre.fr |

| Legal System | Civil Law |

| Type of Solution | Policy Development and Implementation Technology Adoption and Integration |

Context — Problem/Issue

France’s gas infrastructure is a critical component of its energy system, playing a significant role in the country’s energy supply, heating and industrial processes. The infrastructure includes a comprehensive network of pipelines for transportation, storage facilities to manage supply and demand fluctuations and LNG (Liquefied Natural Gas) terminals for imports. French gas demand, heavily influenced by weather due to its primary use in heating, exhibits significant variability, with daily consumption potentially quadrupling from August to February. As France moves towards its 2050 carbon neutrality goal, the gas infrastructure is undergoing significant transformations to accommodate the shift from fossil-based natural gas to renewable gases, such as biogas and hydrogen (France 2).

France’s Energy Code considers the right to inject into the gas networks for biogas producers. The reinforcement of natural gas transportation and distribution networks required to facilitate biogas injection is included in the Decree No. 2019-665 of June 28, 2019, specifying the technical, operational and regulatory measures to be implemented by the French Energy Regulatory Commission (Commission de Régulation de l’Énergie, CRE) to ensure that the gas networks can safely and efficiently handle the biogas injection.

The CRE published, in April 2023, a report on the future of gas infrastructures within the framework of achieving carbon neutrality by 2050, aiming to shed light on the impact of various gas production and consumption scenarios for 2030 and 2050 on gas infrastructures. CRE explored three scenarios, with gas consumption volumes projected between 165 and 320 TWh by 2050. These scenarios emphasize a balanced national production and consumption of green gas, eliminating the use of fossil gas by 2050 while ensuring France’s energy sovereignty. The CRE envisions a future with reduced carbon emissions, in which gas infrastructures like transmission and distribution networks will play a crucial role. These elements are considered essential to achieving a successful energy transition and securing France’s energy independence by mid-century.

The report highlights two main effects on gas infrastructure: the adaptation of networks to accommodate distributed green gas production and the changing needs for gas distribution to consumers. CRE presents nine key findings to guide future considerations on the role of gas in France’s energy mix and strategies for infrastructure development, including the necessity of substantial investments in network adaptation, the continued importance of the current transport network despite reduced consumption and the potential for optimizing the gas distribution network with a focus on green gas production. Additionally, the report discusses the interplay between different energy networks, the ongoing necessity of large methane terminals for supply security and the potential role of hydrogen in the energy mix without overestimating its impact on current gas infrastructure. CRE plans to continue its work to assess the economic consequences of different infrastructure configurations for operators and consumers and to adjust the regulatory framework accordingly to reflect the potential dynamics explored in its report.

Furthermore, in February 2024, the CRE issued its approval of connection zones for integrating renewable or low-carbon gases into gas networks. This decision establishes a legal and operational framework for biogas producers, defining how zones are determined and how local stakeholders are involved. The CRE validated 21 zoning projects, aiming to streamline the injection of renewable gases and ensure that technical and economic considerations are addressed for investment and connection efforts.

Similar Examples

Azerbaijan's energy sector transformation and regulatory evolution (Azerbaijan)

URCA facilitating renewable integration (The Bahamas)

Self-generator pilot program to foster renewable energy (Grenada)

Responsibly sourced gas program limited by lack of decarbonization objective (Michigan)

BCUC's role in steering British Columbia towards a sustainable energy landscape (British Columbia)

Gas Infrastructure considered crucial to achieve decarbonization by 2050 (France)

ARERA balancing energy investments and sustainability with ROSS and TOTEX approach (Italy)

Charting the path to net-zero: CER's role in shaping Canada's energy transition (Canada)

Pilot program- optional premium payment to encourage renewable electricity supply (Michigan)

CNE's adaptative role in decarbonization efforts (Chile)

GNERC's strategic initiatives: implementing a sustainable energy landscape (Georgia)

Japan’s launch of long-term decarbonized power resource auctions (Japan)

New Mexico’s regulator ensuring a just transition through energy transition bonds (New Mexico)

EgyptERA’s strategic initiatives paving the way for renewable energy and efficiency

Responding to a broader regulatory mandate (United Kingdom)

Assessing ratepayer funding of a hybrid heating program (Canada, Québec)

Enabling regulatory change through regulatory sandboxes (Italy)

Getting government support for electricity tariffs that promote electrification (Ontario)

Addressing carbon content in solar PV procurement (France)

Interpreting new requirements to consider decarbonization in regulatory decision making (Australia)

EPRA's regulatory innovations fueling renewable adoption and EV infrastructure (Kenya)

Planning requirements — requiring utilities to model a decarbonized future (Michigan)

Australia and Western Aus

Australian energy regulators pushing the extension of gas regulations to embrace hydrogen and renewable gases (Australia & Western Aus)

While hydrogen as an energy carrier is still at the nascent stage, some regulators have been advising governments on how to address the implications of regulating the development of hydrogen infrastructure. In Australia, taking into account advice from the Australian Energy Market Commission (AEMC), Australian Energy Regulator (AER) and the Western Australia Economic Regulation Authority, Australian energy ministers agreed to extend the national natural gas regulatory framework to include hydrogen and renewable gases. Supporting legislation at the state level is now being passed.

Themes

Importance of government-regulator relationship in implementing sensitive decarbonization initiatives

Changes to the legal framework

Main Findings

Regulators are creatively addressing decarbonization

The regulatory handbrake on investment must be released

Recommendations

For Government: Gather regulators’ inputs

For Government: More resources

For Regulators: Advise governments on practical implications

For Regulators: Reform regulatory processes

Key Insights

Government-regulator relationship

Application of decarbonization criteria in recent decisions

Appropriateness of existing legal/regulatory framework in addressing decarbonization

Potential Enhancements to the legal/regulatory framework

| Where | Australia |

| Who | Australian Energy Market Commission (AEMC) Australian Energy Regulator (AER) Economic Regulation Authority (Western Australia) |

| Link Organization | https://www.aemc.gov.au https://www.aer.gov.au/ http://www.erawa.com.au/ |

| Legal System | Common Law |

| Type of Solution | Policy Development and Implementation Technology Adoption and Integration Public and Stakeholder Engagement |

Context — Problem/Issue

Australia is navigating a significant transition in its energy system from a centralized, fossil fuel-based system to one which is decentralized, renewable energy-based and aiming for net-zero emissions by 2050. Hydrogen is expected to play a big role in this transition that will need adaptations in both electricity and gas transmission and distribution networks, a process overseen by the Australian Energy Regulator (AER). In 2019, the government of Australia was one of the first countries to launch a National Hydrogen Strategy (reviewed in 2023 by public consultation) that outlines its vision to build a clean, innovative, safe and competitive hydrogen industry, designed to position Australia as a major global player in hydrogen production and export by 2030. It emphasizes leveraging the country’s abundant renewable energy resources to produce green hydrogen and its available pipeline, the longest in the world. It recognizes hydrogen’s significant role in achieving net-zero targets through its application in industry, transport and energy sectors.